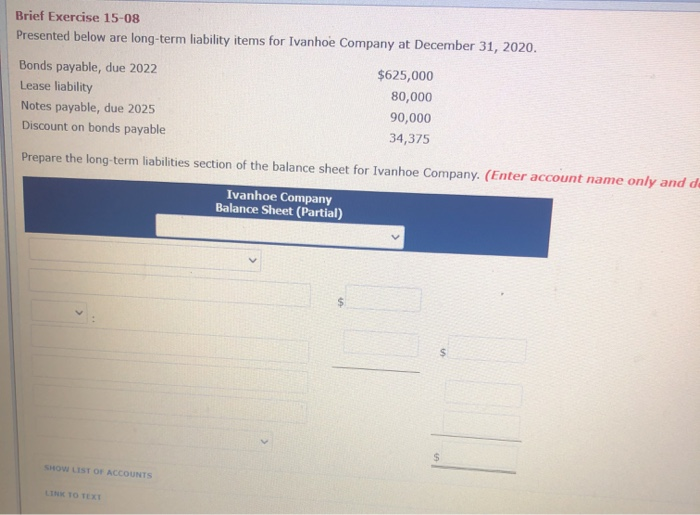

Question: Brief Exercise 15-08 Presented below are long-term liability items for Ivanhoe Company at December 31, 2020. Bonds payable, due 2022 $625,000 Lease liability 80,000 Notes

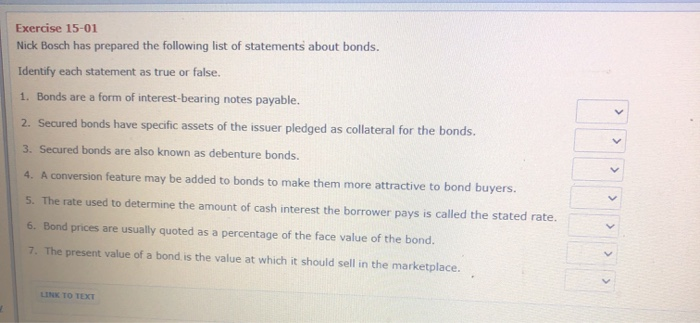

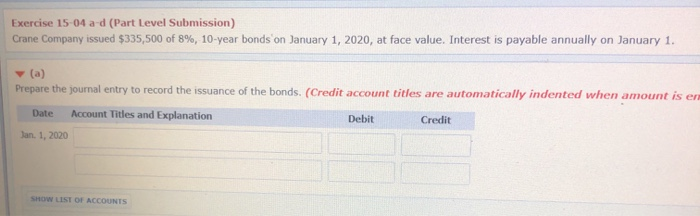

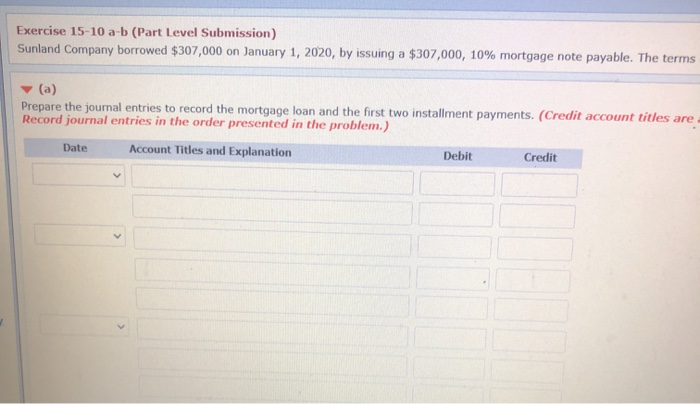

Brief Exercise 15-08 Presented below are long-term liability items for Ivanhoe Company at December 31, 2020. Bonds payable, due 2022 $625,000 Lease liability 80,000 Notes payable, due 2025 90,000 Discount on bonds payable 34,375 Prepare the long-term liabilities section of the balance sheet for Ivanhoe Company. (Enter account name only and de Ivanhoe Company Balance Sheet (Partial) $ $ SHOW LIST OF ACCOUNTS LINK TO TEXT > > Exercise 15-01 Nick Bosch has prepared the following list of statements about bonds. Identify each statement as true or false. 1. Bonds are a form of interest-bearing notes payable. 2. Secured bonds have specific assets of the issuer pledged as collateral for the bonds. 3. Secured bonds are also known as debenture bonds. 4. A conversion feature may be added to bonds to make them more attractive to bond buyers. 5. The rate used to determine the amount of cash interest the borrower pays is called the stated rate. 6. Bond prices are usually quoted as a percentage of the face value of the bond. 7. The present value of a bond is the value at which it should sell in the marketplace. > LINK TO TEXT Exercise 15-10 a-b (Part Level Submission) Sunland Company borrowed $307,000 on January 1, 2020, by issuing a $307,000, 10% mortgage note payable. The terms (a) Prepare the journal entries to record the mortgage loan and the first two installment payments. (Credit account titles are Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Credit Date 1 10% mortgage note payable. The terms call for annual installment payments of $48,000 on December 31. ment payments. (Credit account titles are automatically indented when amount is entered. Do not indent manually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts