Question: Brief Exercise 16-4 (Algo) Temporary difference [LO16-1, 16-3] A company reports pretax accounting income of $40 million, but because of a single temporary difference,

![Brief Exercise 16-4 (Algo) Temporary difference [LO16-1, 16-3] A company reports pretax](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6656c72a9ec41_1146656c72a446c8.jpg)

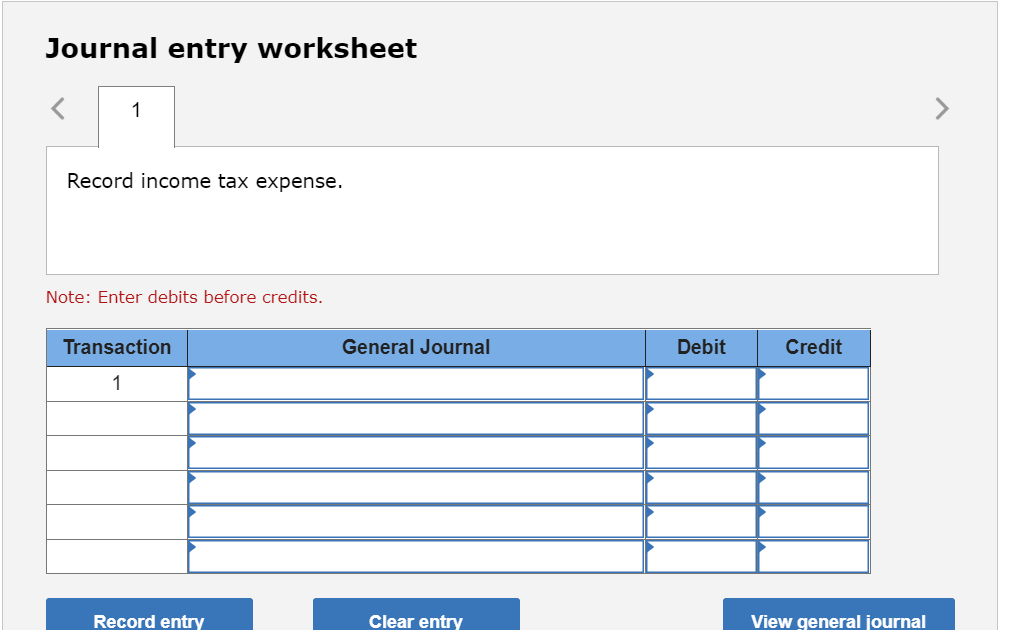

Brief Exercise 16-4 (Algo) Temporary difference [LO16-1, 16-3] A company reports pretax accounting income of $40 million, but because of a single temporary difference, taxable income is $42 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropriate journal entry to record income taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock