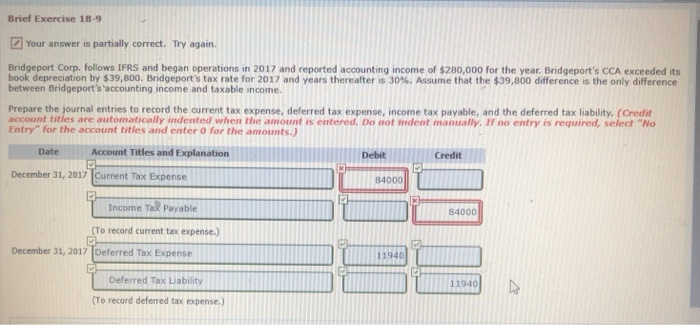

Question: Brief Exercise 18-9 Your answer is partially correct. Try again. Bridgeport Corp. follows IFRS and began operations in 2017 and reported accounting income of $280,000

Brief Exercise 18-9 Your answer is partially correct. Try again. Bridgeport Corp. follows IFRS and began operations in 2017 and reported accounting income of $280,000 for the year. Bridgeport's cCA exceeded its book depreciation by $39,800, Bridgeport's tax rate for 2017 and years thereafter is 30%. Assume that the $39,800 difference is the only difference between Bridgeport's 'accounting income and taxable income Prepare the journal entries to record the aurrent tax expense, deferred tax expense, income tax payable, and the deferred tax liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts. Date Account Titles and Explanation Debit Credit December 31, 2017 Current Tax Expense 84000 Income Ta Payable 84000 (To record current tax expense) December 31, 2017 Deferred Tax Expense 11940 Deferred Tax Liability 11940 To record deferred tax expense.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts