Question: Brief Exercise 19-09 Your answer is partially correct. Try again. Shetland Inc. had pretax financial income of $154,000 in 2020. Included in the computation of

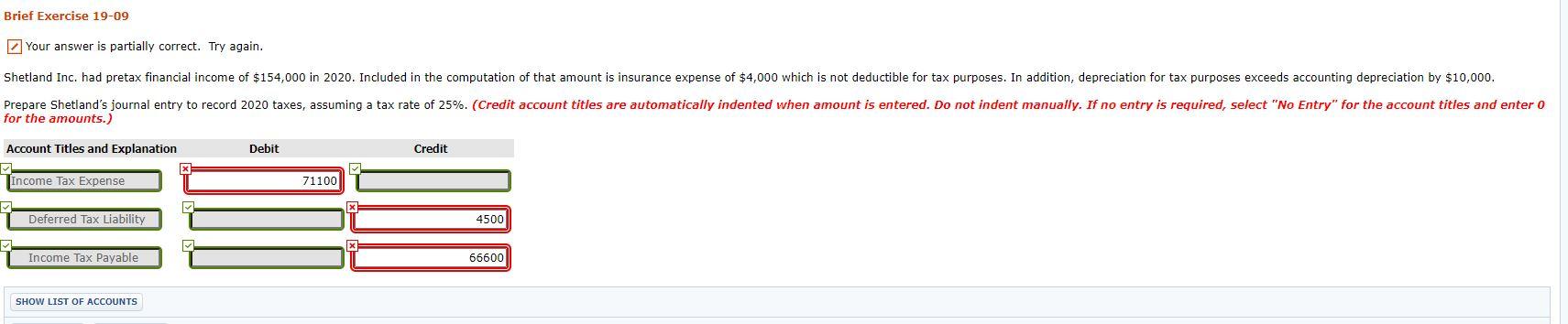

Brief Exercise 19-09 Your answer is partially correct. Try again. Shetland Inc. had pretax financial income of $154,000 in 2020. Included in the computation of that amount is insurance expense of $4,000 which is not deductible for tax purposes. In addition, depreciation for tax purposes exceeds accounting depreciation by $10,000. Prepare Shetland's journal entry to record 2020 taxes, assuming a tax rate of 25%. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Income Tax Expense 71100 Deferred Tax Liability 4500 Income Tax Payable 66600 SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts