Question: Brief Exercise 21A-15 CALCULATOR PULL SCREEN PRINTER VERSION BACK NEXT Your answer is partially correct. Try again. LeBron James (8) Corporation agrees on January 1,

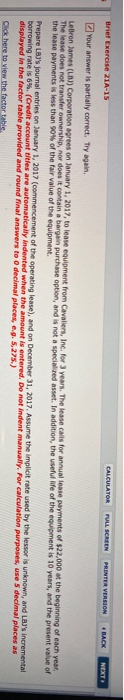

Brief Exercise 21A-15 CALCULATOR PULL SCREEN PRINTER VERSION BACK NEXT Your answer is partially correct. Try again. LeBron James (8) Corporation agrees on January 1, 2017, to lease equipment from Cavaliers, Inc. for 3 years. The lease calls for annual lease payments of $22,000 at the beginning of each year, The lease does not transfer ownership, nor does it contain a bargain purchase option, and is not a specialized asset. In addition, the useful life of the equipment is 10 years, and the present value of the lease payments is less than go of the fair value of the equipment. Prepare Lu's journal entries on January 1, 2017 (commencement of the operating lease), and on December 31, 2017. Assume the implicit rate used by the lessor is unknown, and Lau's incremental borrowing rate is 6%. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round Rinal answers to decimal places, e.g. 5,275.) Click here to view the factor table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts