Question: Brief Exercise 3-10 Record the adjusting entry for deferred revenue (LO3-3) Suppose a customer rents a vehicle for three months from Commodores Rental on November

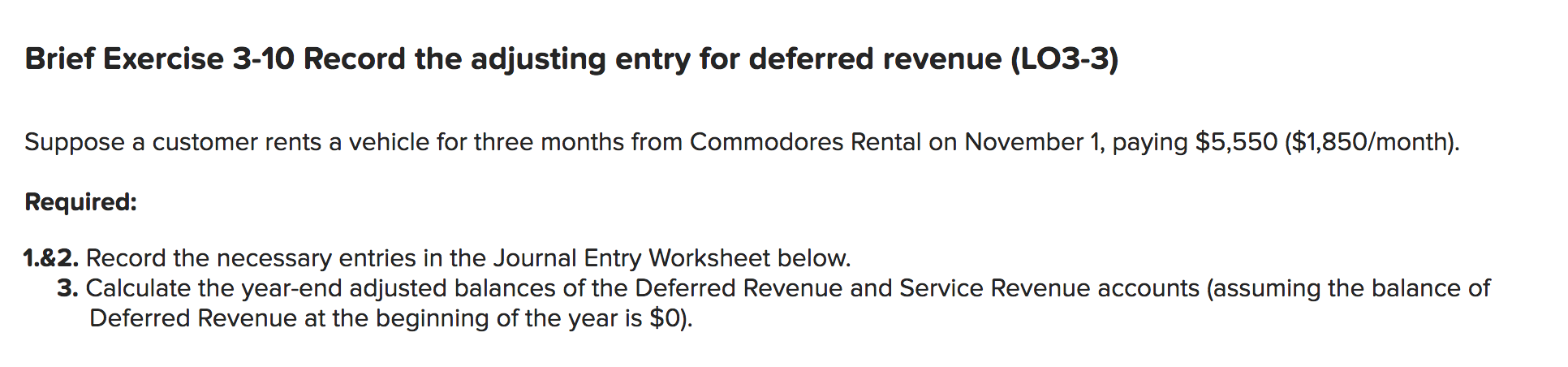

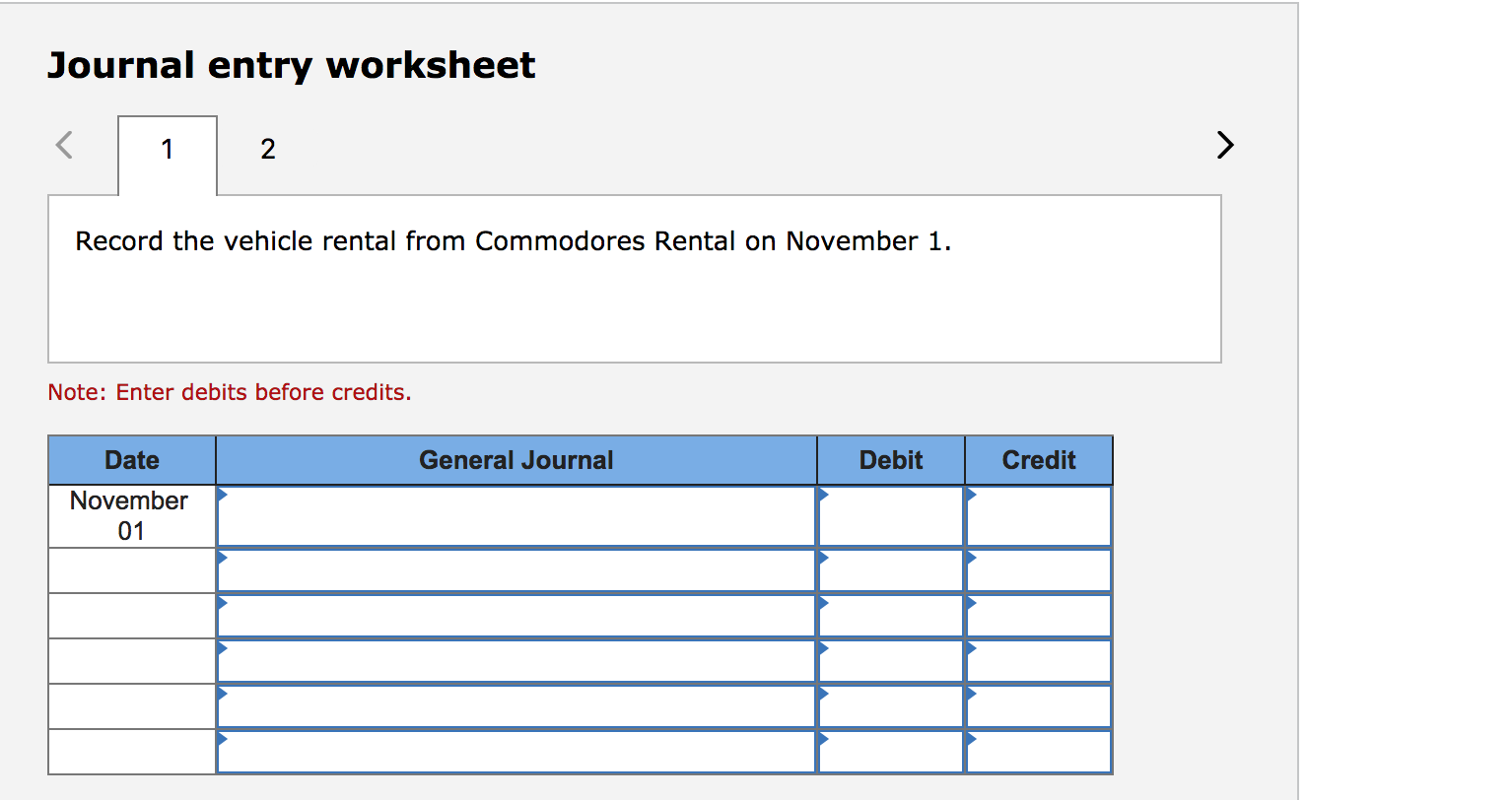

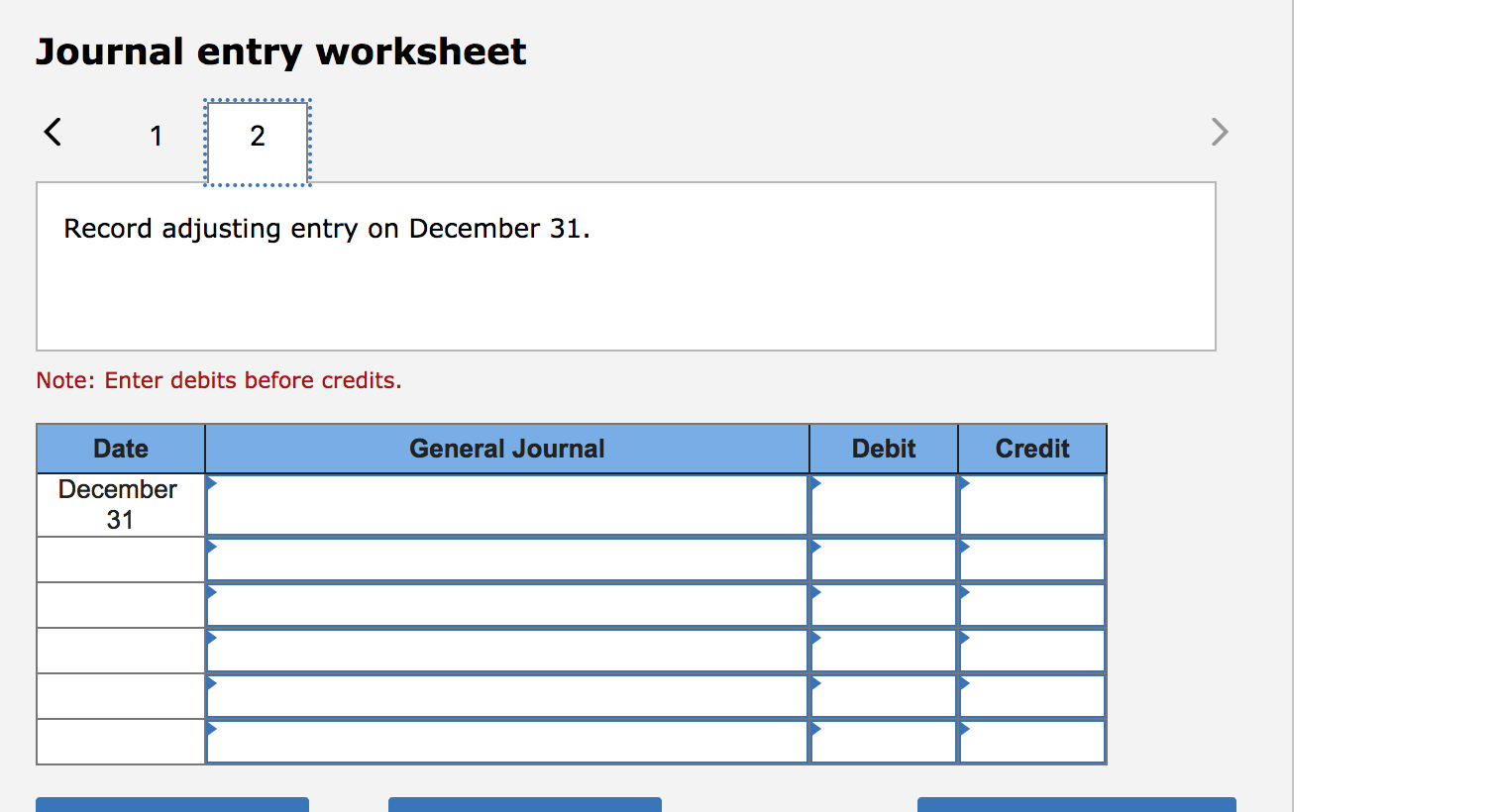

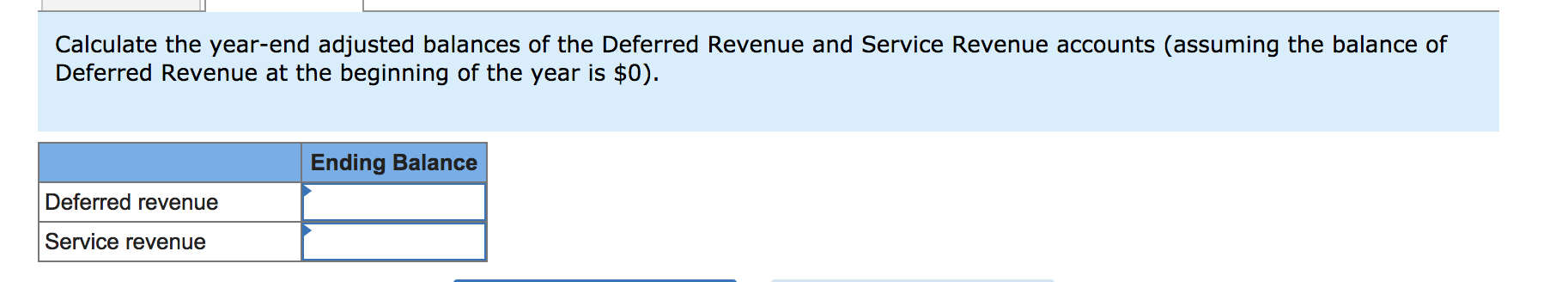

Brief Exercise 3-10 Record the adjusting entry for deferred revenue (LO3-3) Suppose a customer rents a vehicle for three months from Commodores Rental on November 1, paying $5,550 ($1,850/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of the Deferred Revenue and Service Revenue accounts (assuming the balance of Deferred Revenue at the beginning of the year is $0). Journal entry worksheet 1 2 > Record the vehicle rental from Commodores Rental on November 1. Note: Enter debits before credits. Date General Journal Debit Credit November 01 Journal entry worksheet Record adjusting entry on December 31. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Calculate the year-end adjusted balances of the Deferred Revenue and Service Revenue accounts (assuming the balance of Deferred Revenue at the beginning of the year is $0). Ending Balance Deferred revenue Service revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts