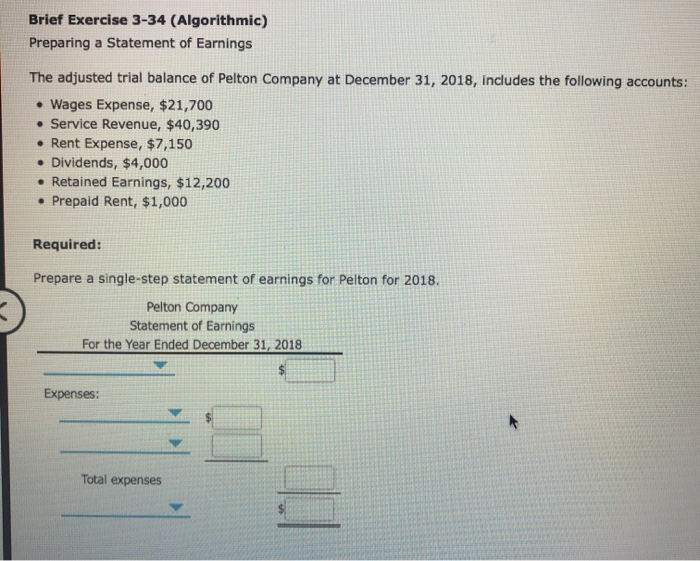

Question: Brief Exercise 3-34 (Algorithmic) Preparing a Statement of Earnings The adjusted trial balance of Pelton Company at December 31, 2018, includes the following accounts: Wages

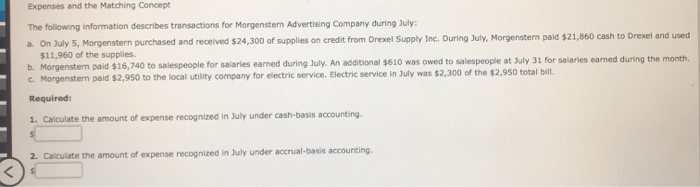

Brief Exercise 3-34 (Algorithmic) Preparing a Statement of Earnings The adjusted trial balance of Pelton Company at December 31, 2018, includes the following accounts: Wages Expense, $21,700 Service Revenue, $40,390 Rent Expense, $7,150 Dividends, $4,000 Retained Earnings, $12,200 Prepaid Rent, $1,000 Required: Prepare a single-step statement of earnings for Pelton for 2018. Pelton Company Statement of Earnings For the Year Ended December 31, 2018 Expenses: Total expenses Expenses and the Matching Concept The following information describes transactions for Morgenstern Advertising Company during July a. On July 5, Morgenstern purchased and received $24,300 of supplies on credit from Drexel Supply Inc. During July, Morgenstern paid $21,860 cash to Drexel and used $11,960 of the supplies b. Morgenstern paid $16,740 to salespeople for salaries earned during July. An additional $610 was owed to salespeople at July 31 for salaries earned during the month. c. Morgenstern paid $2,950 to the local utility company for electric service. Electric service in July was $2,300 of the $2,950 total bill. Required: 1. Calculate the amount of expense recognized in July under cash-basis accounting 2. Calculate the amount of expense recognized in July under accrual-basis accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts