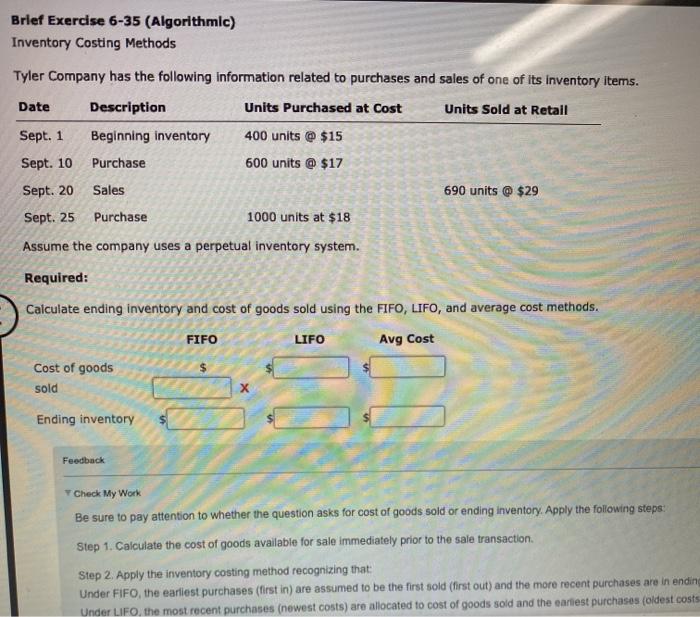

Question: Brief Exercise 6-35 (Algorithmic) Inventory Costing Methods Tyler Company has the following information related to purchases and sales of one of its inventory items. Date

Brief Exercise 6-35 (Algorithmic) Inventory Costing Methods Tyler Company has the following information related to purchases and sales of one of its inventory items. Date Description Units Purchased at Cost Units Sold at Retail Sept. 1 Beginning inventory 400 units @ $15 Sept. 10 Purchase 600 units @ $17 Sept. 20 Sales 690 units @ $29 Sept. 25 Purchase 1000 units at $18 Assume the company uses a perpetual inventory system. Required: Calculate ending inventory and cost of goods sold using the FIFO, LIFO, and average cost methods. FIFO LIFO Avg Cost Cost of goods sold $ Ending inventory Feedback Check My Work Be sure to pay attention to whether the question asks for cost of goods sold or ending inventory. Apply the following steps: Step 1. Calculate the cost of goods available for sale immediately prior to the sale transaction Step 2. Apply the inventory costing method recognizing that Under FIFO, the earliest purchases (first in) are assumed to be the first sold (first out) and the more recent purchases are in ending Under LIFO, the most recent purchases (newest costs) are allocated to cost of goods sold and the earliest purchases (oldest costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts