Question: Brief Exercise 8-16 Bramble Enterprises Ltd's records reported an inventory cost of $55,800 and a net realizable value of $52,200 at December 31, 2015. At

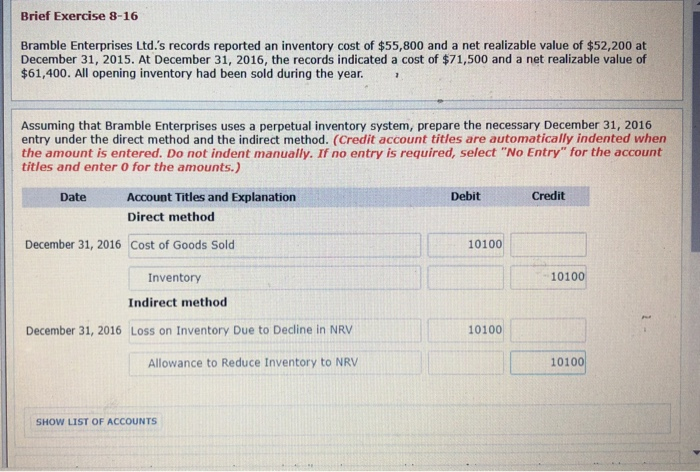

Brief Exercise 8-16 Bramble Enterprises Ltd's records reported an inventory cost of $55,800 and a net realizable value of $52,200 at December 31, 2015. At December 31, 2016, the records indicated a cost of $71,500 and a net realizable value of $61,400. All opening inventory had been sold during the year. Assuming that Bramble Enterprises uses a perpetual inventory system, prepare the necessary December 31, 2016 entry under the direct method and the indirect method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Account Titles and Explanation Direct method Date December 31, 2016 Cost of Goods Sold 10100 Inventory 10100 Indirect method December 31, 2016 Loss on Inventory Due to Decline in NRV 10100 Allowance to Reduce Inventory to NRV 10100 Show LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts