Question: Brief Exercise 8-8 LIFO method [LO8-4) Esquire Inc. uses the LIFO method to value its inventory Inventory at January 1, 2018, was $500,000 (25,000 units

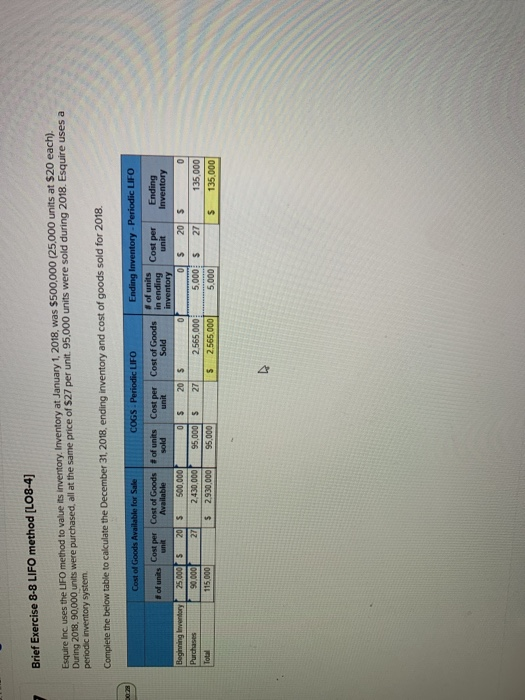

Brief Exercise 8-8 LIFO method [LO8-4) Esquire Inc. uses the LIFO method to value its inventory Inventory at January 1, 2018, was $500,000 (25,000 units at $20 each) During 2018, 90,000 units were purchased, all at the same price of $27 per unit. 95,000 units were sold during 2018. Esquire uses a periodic inventory system Complete the below table to calculate the December 31, 2018, ending inventory and cost of goods sold for 2018 Cost of Goods Available for Sale COGS. Periodic LIFO of units Cost per Cost of Goods #of units Cost per Cost of Goods S unt Available sold unit Sold 25.000 20 $ 500.000 $ 20 $ 90.000 27 2.430,000 95,000 5 27 2.565,000 $ 2,930,000 95,000 S 2.565.000 Ending Inventory - Periodic LIFO of units Cost per Ending in ending unit inventory Inventory ol$ 20 $ 0 5,000 5 27 135,000 5,000 $ 135,000 Beginning Inventory Purchases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts