______________________________________!!!!!!!

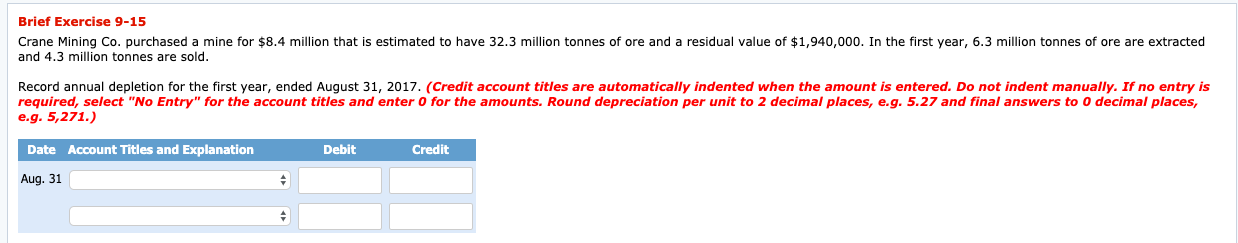

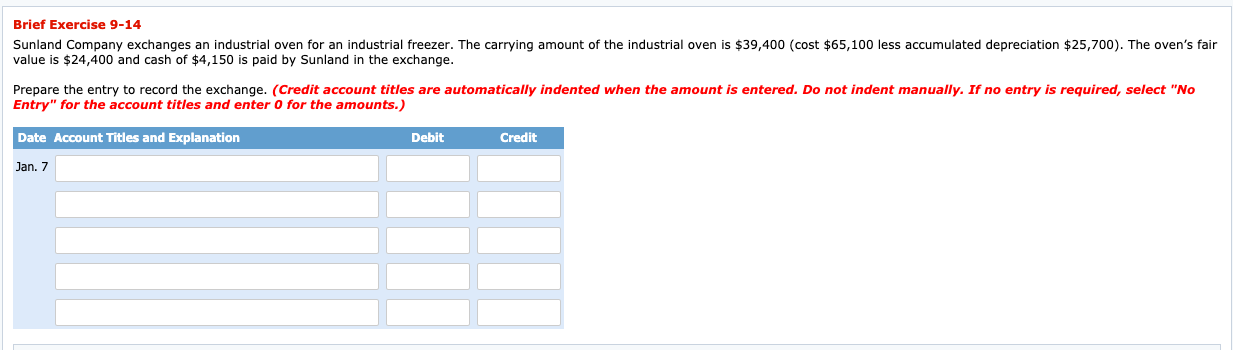

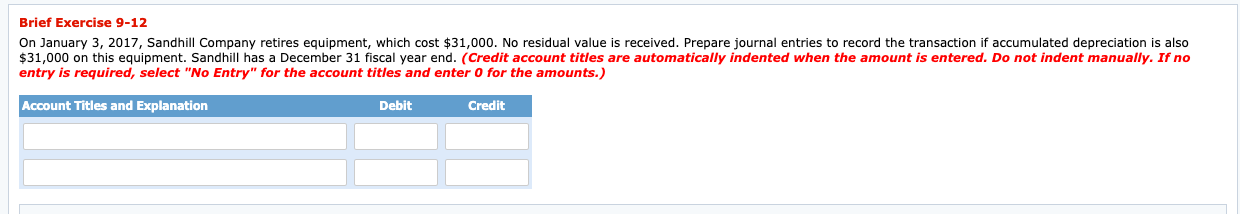

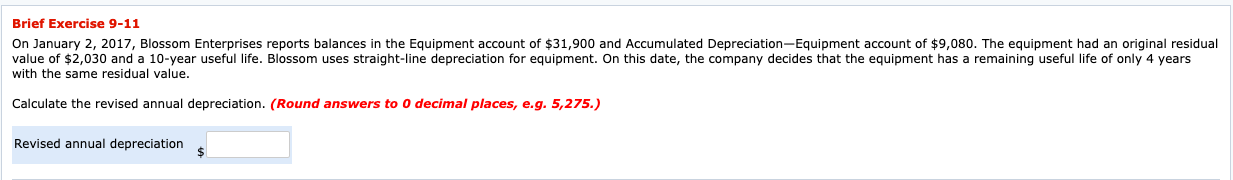

Brief Exercise 9-15 Crane Mining Co. purchased a mine for $8.4 million that is estimated to have 32.3 million tonnes of ore and a residual value of $1,940,000. In the first year, 6.3 million tonnes of ore are extracted and 4.3 million tonnes are sold. Record annual depletion for the first year, ended August 31, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is e.g. 5,271.) required, select "No Entry" for the account titles and enter 0 for the amounts. Round depreciation per unit to 2 decimal places, e.g. 5.27 and final answers to 0 decimal places, Date Account Titles and Explanation Debit Credit Aug. 31Brief Exercise 9-14 Sunland Company exchanges an industrial oven for an industrial freezer. The carrying amount of the industrial oven is $39,400 (cost $65,100 less accumulated depreciation $25,700). The oven's fair value is $24,400 and cash of $4,150 is paid by Sunland in the exchange. Prepare the entry to record the exchange. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 7Brief Exercise 9-12 On January 3, 2017, Sandhill Company retires equipment, which cost $31,000. No residual value is received. Prepare journal entries to record the transaction if accumulated depreciation is also $31,000 on this equipment. Sandhill has a December 31 fiscal year end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit CreditBrief Exercise 9-11 On January 2, 2017, Blossom Enterprises reports balances in the Equipment account of $31,900 and Accumulated Depreciation-Equipment account of $9,080. The equipment had an original residual value of $2,030 and a 10-year useful life. Blossom uses straight-line depreciation for equipment. On this date, the company decides that the equipment has a remaining useful life of only 4 years with the same residual value. Calculate the revised annual depreciation. (Round answers to 0 decimal places, e.g. 5,275.) Revised annual depreciation $