Question: Brief Exercise 9-8 Record bond issue at a premium and related semiannual interest (LO9-5) Pretzelmania, Inc., issues 6%, 10-year bonds with a face amount of

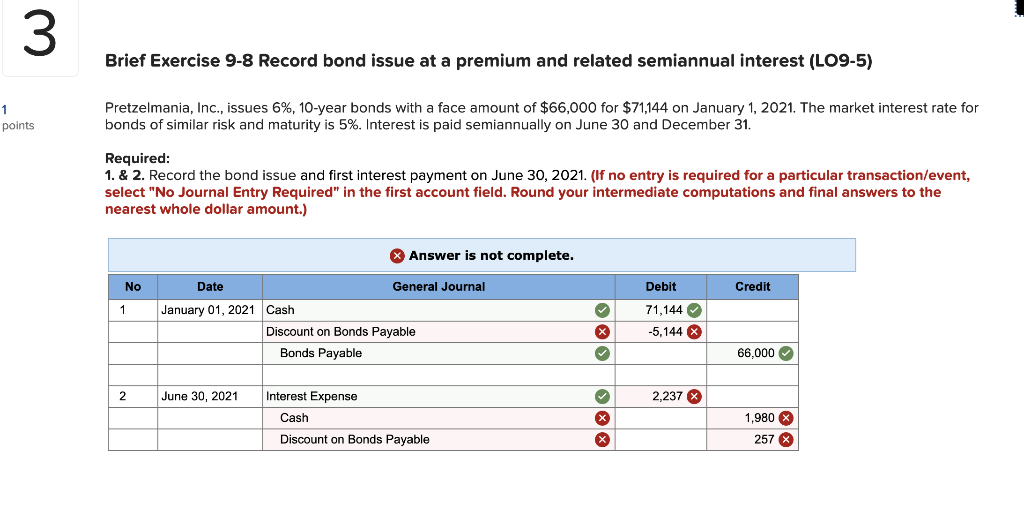

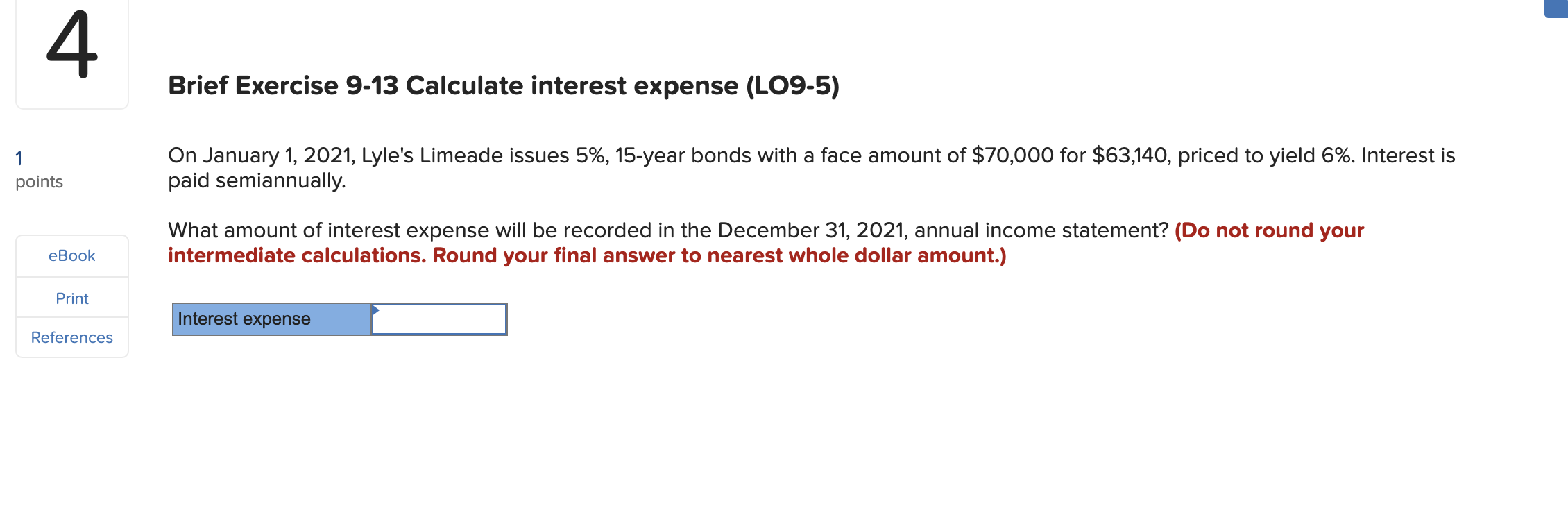

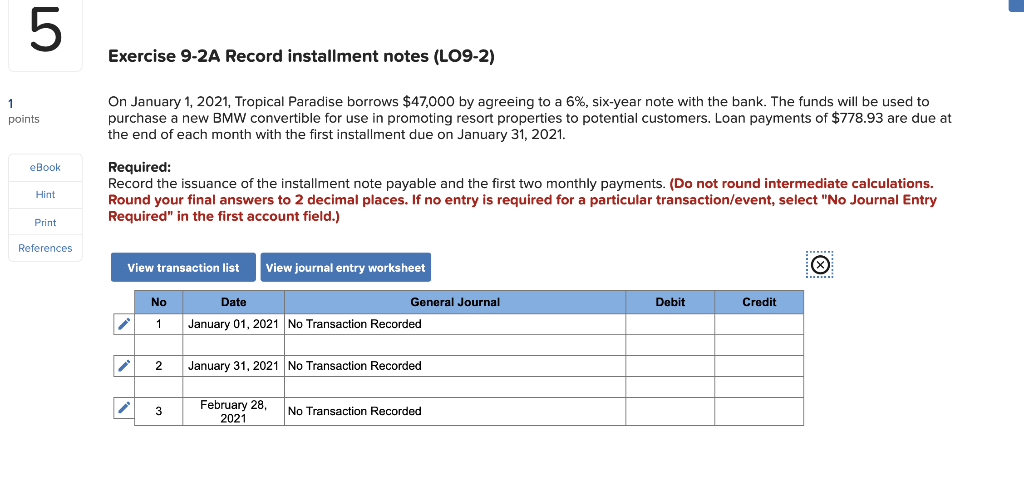

Brief Exercise 9-8 Record bond issue at a premium and related semiannual interest (LO9-5) Pretzelmania, Inc., issues 6%, 10-year bonds with a face amount of $66,000 for $71,144 on January 1, 2021. The market interest rate for bonds of similar risk and maturity is 5%. Interest is paid semiannually on June 30 and December 31, points Required: 1. & 2. Record the bond issue and first interest payment on June 30, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your intermediate computations and final answers to the nearest whole dollar amount.) % Answer is not complete. Credit No 1 Date General Journal January 01, 2021 Cash Discount on Bonds Payable Bonds Payable Debit 71,144 -5,144 X 66,000 June 30, 2021 2,237 X Interest Expense Cash Discount on Bonds Payable 1,980 257 Brief Exercise 9-13 Calculate interest expense (LO9-5) On January 1, 2021, Lyle's Limeade issues 5%, 15-year bonds with a face amount of $70,000 for $63,140, priced to yield 6%. Interest is paid semiannually. points What amount of interest expense will be recorded in the December 31, 2021, annual income statement? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar amount.) eBook Print Interest expense References Exercise 9-2A Record installment notes (LO9-2) points On January 1, 2021, Tropical Paradise borrows $47,000 by agreeing to a 6%, six-year note with the bank. The funds will be used to purchase a new BMW convertible for use in promoting resort properties to potential customers. Loan payments of $778.93 are due at the end of each month with the first installment due on January 31, 2021. eBook Hint Required: Record the issuance of the installment note payable and the first two monthly payments. (Do not round intermediate calculations. Round your final answers to 2 decimal places. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Print References View transaction list View journal entry worksheet Debit Credit No 1 Date General Journal January 01, 2021 No Transaction Recorded 2 January 31, 2021 No Transaction Recorded 3 February 28, 2021 No Transaction Recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts