Question: Briefly comment on the similarities and differences between the three market indexes. (SomeFIN 310: INVESTMENTS Spring 2024 Pr. Oleg Bondarenko Project 1 General instructions: The

Briefly comment on the similarities and differences between the three market indexes. (SomeFIN 310: INVESTMENTS\ Spring 2024\ Pr. Oleg Bondarenko\ Project 1\ General instructions: The objective of the project is to enhance students' understanding of stock\ indexes. For this project, you will use Microsoft Excel and work in groups of 4. One report should be\ submitted for each group and everyone in a group will receive the same grade.\ Name the very first sheet as "Summary" and include in it the final answers. To make answers easily\ found, use appropriate labels, arrows, and highlights. The answers in "Summary" sheet should be\ linked to the actual computations in other sheets. If you create a chart, place it in a separate sheet and\ name it intuitively (say, "Chart Q1.3"). If your answers are hard to locate, points could be subtracted.\ Spreadsheet file Project1_Data.xls contains monthly data for stocks of three software companies and\ for three market indexes starting from December 2003 to 2023. The three companies are Adobe\ Systems, Microsoft Corporation, and Oracle Corporation. The three market indexes are NASDAQ\ 100, Russell 2003, and S&P 500.\ I. Industry Indexes.\ As a young portfolio manager for a sector fund, your objective is to construct various indexes for the\ software industry and to study their historical performance. The indexes will consist of three stocks:\ Adobe Systems (ADBE), Microsoft Corp. (MSFT), and Oracle Corp. (ORCL).\ Compute monthly returns for ADBE, MSFT, and ORCL. Use formula:\ Return Price This Month-Price Last Month \ ideas: compare correlations between the indexes, how the indexes performed during Great\ Financial Crisis and Covid crisis, lowest and highest returns).

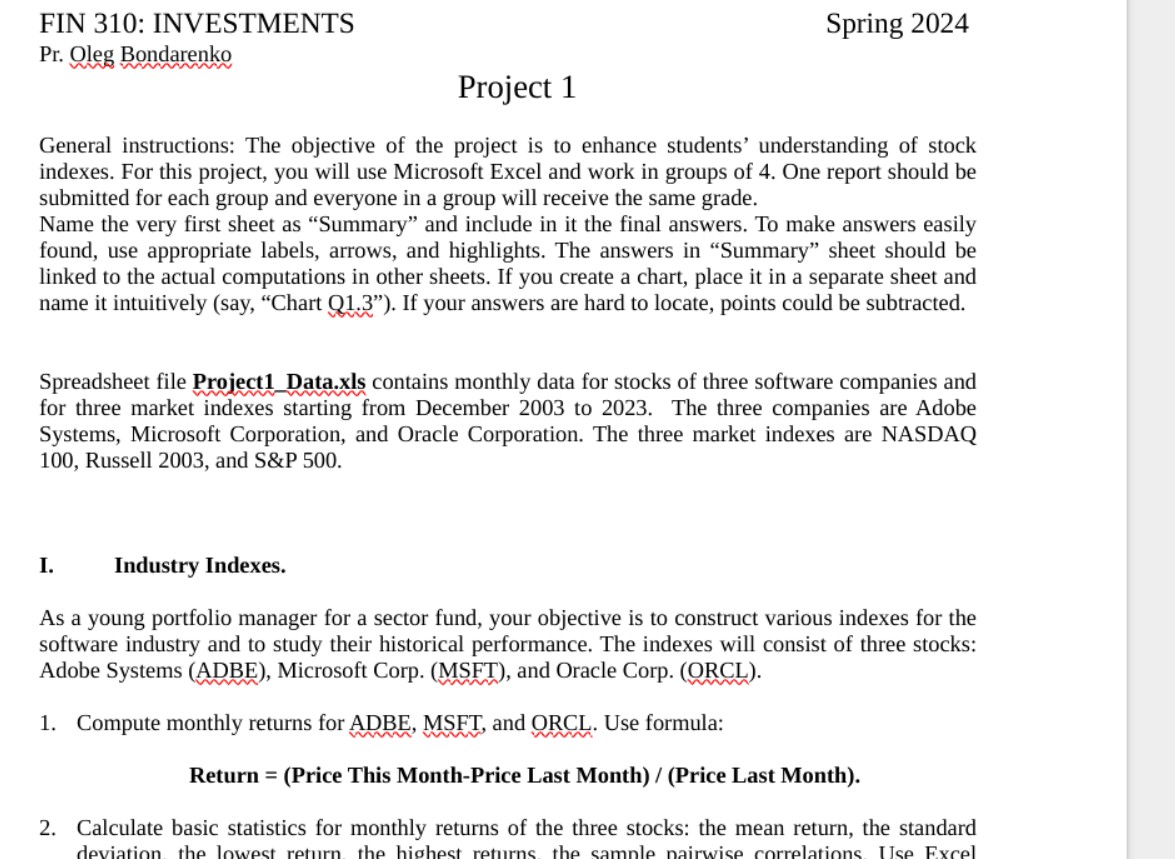

Project 1 General instructions: The objective of the project is to enhance students' understanding of stock indexes. For this project, you will use Microsoft Excel and work in groups of 4. One report should be submitted for each group and everyone in a group will receive the same grade. Name the very first sheet as "Summary" and include in it the final answers. To make answers easily found, use appropriate labels, arrows, and highlights. The answers in "Summary" sheet should be linked to the actual computations in other sheets. If you create a chart, place it in a separate sheet and name it intuitively (say, Chart Q1.3"). If your answers are hard to locate, points could be subtracted. Spreadsheet file Project1_Data.xls contains monthly data for stocks of three software companies and for three market indexes starting from December 2003 to 2023. The three companies are Adobe Systems, Microsoft Corporation, and Oracle Corporation. The three market indexes are NASDAQ 100, Russell 2003, and S\&P 500. I. Industry Indexes. As a young portfolio manager for a sector fund, your objective is to construct various indexes for the software industry and to study their historical performance. The indexes will consist of three stocks: Adobe Systems (ADBE), Microsoft Corp. (MSFT), and Oracle Corp. (ORCL). 1. Compute monthly returns for ADBE,MSFT, and ORCL. Use formula: Return=(PriceThisMonth-PriceLastMonth)/(PriceLastMonth). 2. Calculate basic statistics for monthly returns of the three stocks: the mean return, the standard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts