Question: Briefly discuss possible advantages to a multinational company from using a holding company based in a tax have: Kato company needs one year loan of

Briefly discuss possible advantages to a multinational company from using a holding company based in a tax have:

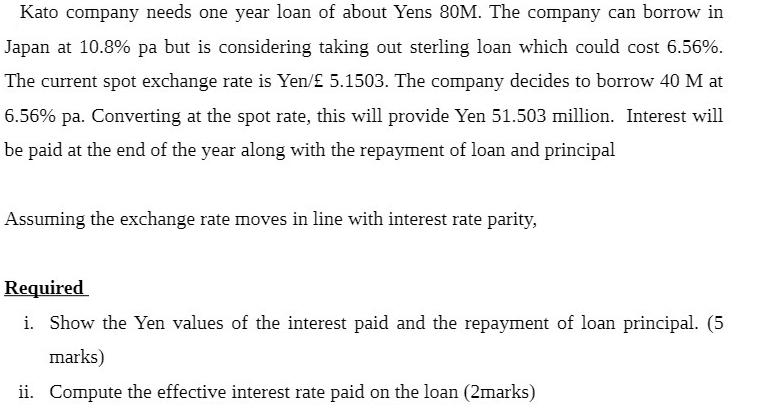

Kato company needs one year loan of about Yens 80M. The company can borrow in Japan at 10.8% pa but is considering taking out sterling loan which could cost 6.56%. The current spot exchange rate is Yen/ 5.1503. The company decides to borrow 40 M at 6.56% pa. Converting at the spot rate, this will provide Yen 51.503 million. Interest will be paid at the end of the year along with the repayment of loan and principal Assuming the exchange rate moves in line with interest rate parity, Required i. Show the Yen values of the interest paid and the repayment of loan principal. (5 marks) ii. Compute the effective interest rate paid on the loan (2marks)

Step by Step Solution

3.48 Rating (174 Votes )

There are 3 Steps involved in it

SOLUTION A holding company is a type of company that owns a controlling interest in other companies usually for the purpose of managing and controlling assets or investments A multinational company ma... View full answer

Get step-by-step solutions from verified subject matter experts