Question: Brightside Communications is evaluating a 5-year project that requires the purchase of a new machine costing $200,000. The machine will be depreciated on a

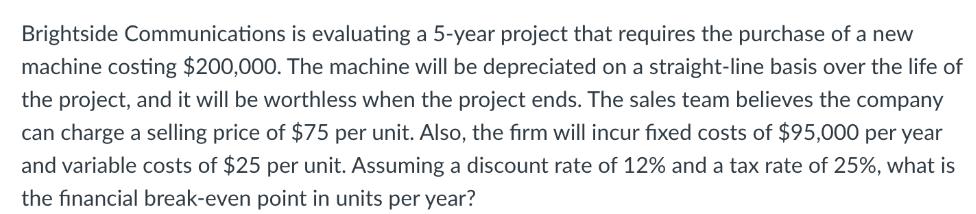

Brightside Communications is evaluating a 5-year project that requires the purchase of a new machine costing $200,000. The machine will be depreciated on a straight-line basis over the life of the project, and it will be worthless when the project ends. The sales team believes the company can charge a selling price of $75 per unit. Also, the firm will incur fixed costs of $95,000 per year and variable costs of $25 per unit. Assuming a discount rate of 12% and a tax rate of 25%, what is the financial break-even point in units per year?

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

To calculate the financial breakeven point in units per year we need to determine the number of unit... View full answer

Get step-by-step solutions from verified subject matter experts