Question: BrightStar Limited, ( ' BrightStar ' ) , a property investment company, needs funding to acquire 7 0 % of the equity shares in Skyview

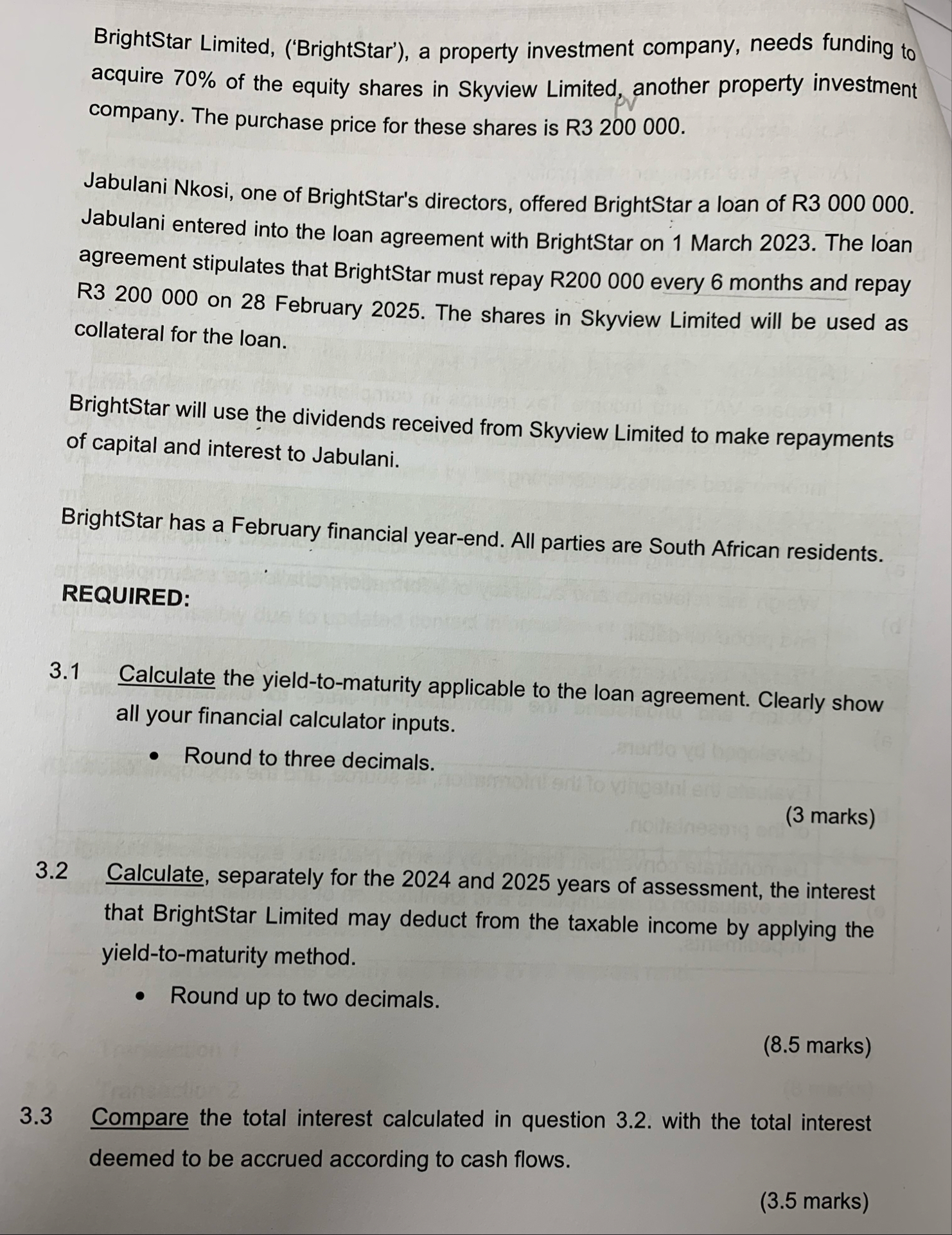

BrightStar Limited, BrightStar a property investment company, needs funding to acquire of the equity shares in Skyview Limited, another property investment company. The purchase price for these shares is R

Jabulani Nkosi, one of BrightStar's directors, offered BrightStar a loan of R Jabulani entered into the loan agreement with BrightStar on March The loan agreement stipulates that BrightStar must repay R every months and repay R on February The shares in Skyview Limited will be used as collateral for the loan.

BrightStar will use the dividends received from Skyview Limited to make repayments of capital and interest to Jabulani.

BrightStar has a February financial yearend. All parties are South African residents.

REQUIRED:

Calculate the yieldtomaturity applicable to the loan agreement. Clearly show all your financial calculator inputs.

Round to three decimals.

marks

Calculate, separately for the and years of assessment, the interest that BrightStar Limited may deduct from the taxable income by applying the yieldtomaturity method.

Round up to two decimals.

marks

Compare the total interest calculated in question with the total interest deemed to be accrued according to cash flows.

marks

Briefly discuss the deductibility of the interest incurred by BrightStar Limited in respect of the loan to purchase the shares of Skyview Limited.

Support your answer with references to the relevant sections of the Income Tax Act.

marks

Communication skill: Clarity of expression

mark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock