Question: Brimark Ltd. is considering three possible capital projects for next year. Each project has a 1-year life, and project returns depend on next year's

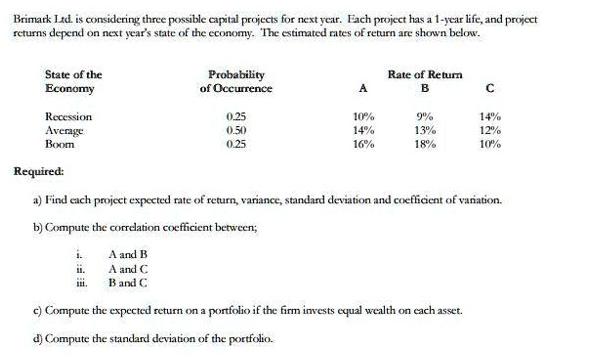

Brimark Ltd. is considering three possible capital projects for next year. Each project has a 1-year life, and project returns depend on next year's state of the economy. The estimated rates of return are shown below. State of the Economy Recession Average Boom Probability of Occurrence ii. 0.25 0.50 0.25 A 10% 14% 16% Rate of Return B 9% 13% 18% C 14% 12% 10% Required: a) Find each project expected rate of return, variance, standard deviation and coefficient of variation. b) Compute the correlation coefficient between; A and B A and C B and C c) Compute the expected return on a portfolio if the firm invests equal wealth on each asset. d) Compute the standard deviation of the portfolio.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

a Expected return of ... View full answer

Get step-by-step solutions from verified subject matter experts