Question: Brokia Electronics manufactures three cell phone models, which differ only in the components included: Basic, Photo, and UrLife. Production takes place in two departments, Assembly

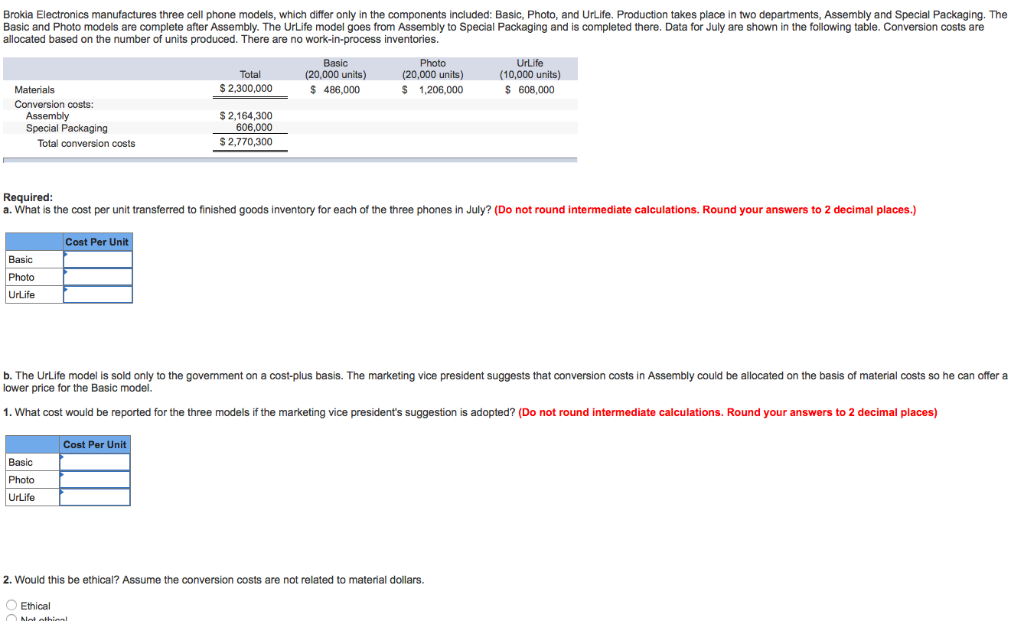

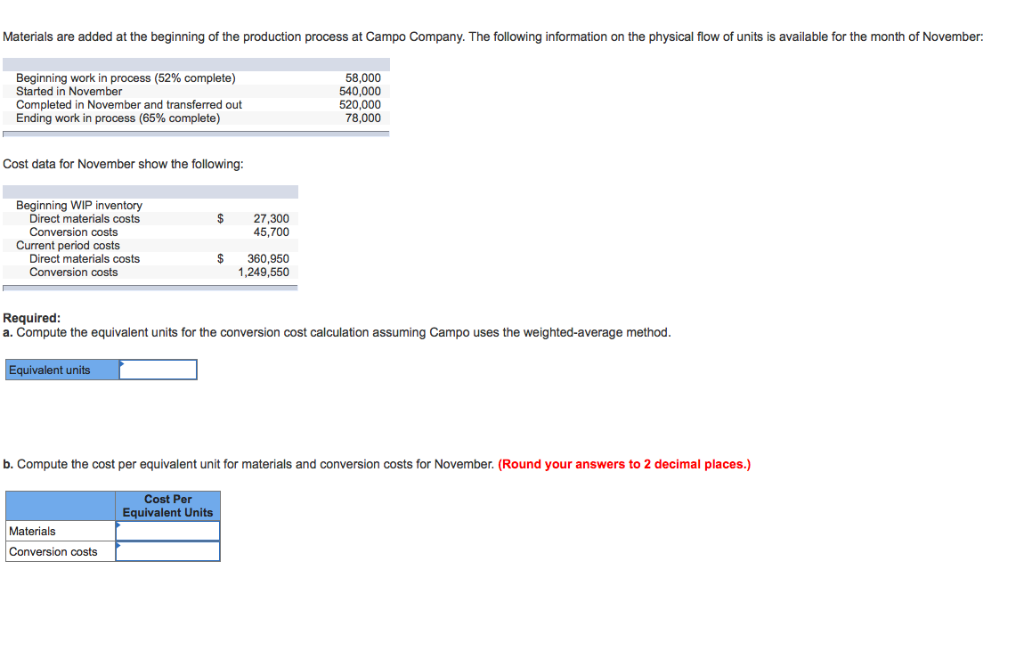

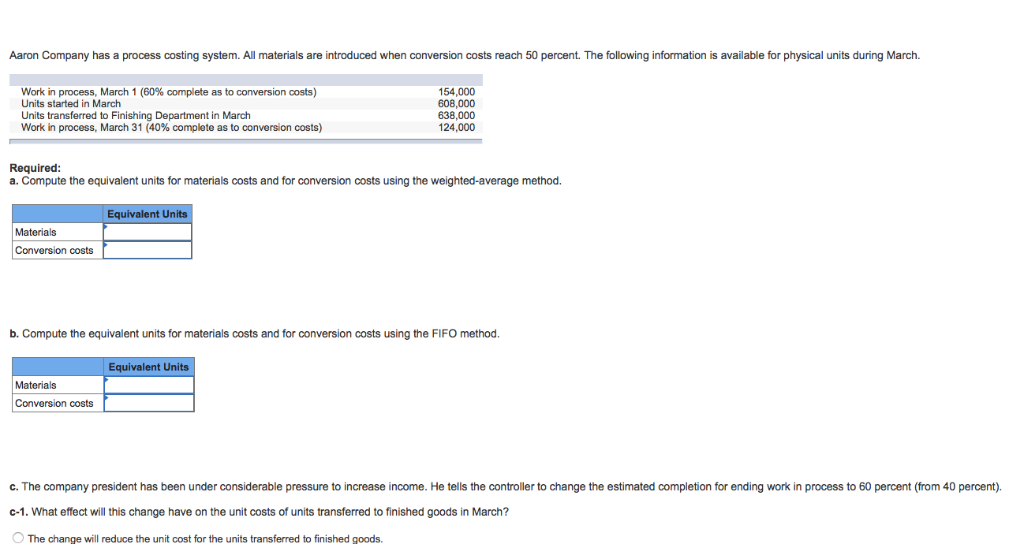

Brokia Electronics manufactures three cell phone models, which differ only in the components included: Basic, Photo, and UrLife. Production takes place in two departments, Assembly and Special Packaging. The Basic and Photo models are complete after Assembly. The UrLife model goes from Assembly to Special Packaging and is completed there. Data for July are shown in the following table. Conversion costs are allocated based on the number of units produced. There are no work-in-process inventories. Basic (20,000 units) $ 486,000 Photo (20,000 units) $ 1,206,000 UrLife (10,000 units) S 608,000 Total $ 2,300,000 $ 2,164,300 $ 2,770,300 Conversion costs: Special Packaging 606,000 Total conversion costs Required a. What is the cost per unit transferred to finished goods inventory for each of the three phones in July? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Cost Per Unit Basic Photo UrLife b. The UrLife model is sold only to the government on a cost-plus basis. The marketing vice president suggests that conversion costs in Assembly could be allocated on the basis of material costs so he can offer a lower price for the Basic model. 1. What cost would be reported for the three models if the marketing vice president's suggestion is adopted? (Do not round intermediate calculations. Round your answers to 2 decimal places) Cost Per Unit Basic Photo UrLife 2. Would this be ethical? Assume the conversion costs are not related to material dollars. O Ethical Beginning work in process (52% complete) Started in November Completed in November and transferred out Ending work in process (65% complete) 58,000 540,000 520,000 78,000 Cost data for November show the following: Beginning WIP inventory $27,300 45,700 Direct materials costs Conversion costs Current period costs Direct materials costs Conversion costs $360,950 1,249,550 Required a. Compute the equivalent units for the conversion cost calculation assuming Campo uses the weighted-average method Equivalent units b. Compute the cost per equivalent unit for materials and conversion costs for November. (Round your answers to 2 decimal places.) Cost Per Equivalent Units Materials Conversion costs Aaron Company has a process costing system. All materials are introduced when conversion costs reach 50 percent. The following information is available for physical units during March. 154,000 608,000 638,000 124,000 Units started in March Units transferred to Finishing Department in March Work in process, March 31 (40% mplete as to conversion costs) Required a. Compute the equivalent units for materials costs and for conversion costs using the weighted-average method. Equivalent Units Materials Conversion costs b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method. Equivalent Units Materials Conversion costs c. The company president has been under considerable pressure to increase income. He tells the controller to change the estimated completion for ending work in process to 60 percent (from 40 percen) c-1. What effect will this change have on the unit costs of units transferred to finished goods in March? The change will reduce the unit cost for the units transferred to finished goods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts