Question: Brompton Ltd has been reviewing its operations and is evaluating the introduction of a new product. There are several versions of the product that

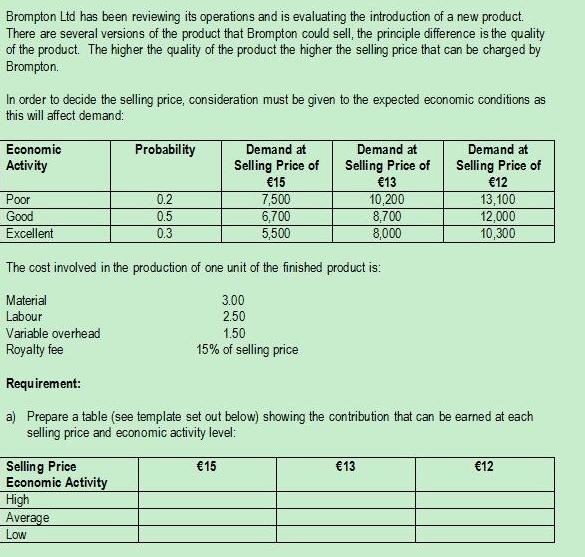

Brompton Ltd has been reviewing its operations and is evaluating the introduction of a new product. There are several versions of the product that Brompton could sell, the principle difference is the quality of the product. The higher the quality of the product the higher the selling price that can be charged by Brompton. In order to decide the selling price, consideration must be given to the expected economic conditions as this will affect demand Economic Activity Probability Demand at Demand at Demand at Selling Price of 15 Selling Price of 13 Selling Price of 12 Poor Good Excellent 7,500 6,700 13,100 12,000 10,300 0.2 10,200 8,700 8,000 0.5 0.3 5,500 The cost involved in the production of one unit of the finished product is: Material 3.00 Labour 2.50 Variable overhead 1.50 Royalty fee 15% of selling price Requirement: a) Prepare a table (see template set out below) showing the contribution that can be earned at each selling price and economic activity level: Selling Price Economic Activity High Average Low 15 13 12 b) Calculate the expected value that can be earned at each selling price. Recommend which selling price should be chosen based on expected value approach for the new product. c) Using the maximax approach what selling price should Brompton set for this new product. d) Using the maximin approach what selling price should Brompton set for this new product. e) Define a decision tree in the context of decision making and outline three limitations of this approach.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

As per expected value approach we will consider selling price 12 for new product because at ... View full answer

Get step-by-step solutions from verified subject matter experts