Question: Bronn took out a fully amortizing, 5/1 hybrid, adjustable rate mortgage of $185566.61 with 18 year maturity. The interest rate is indexed to SOFR and

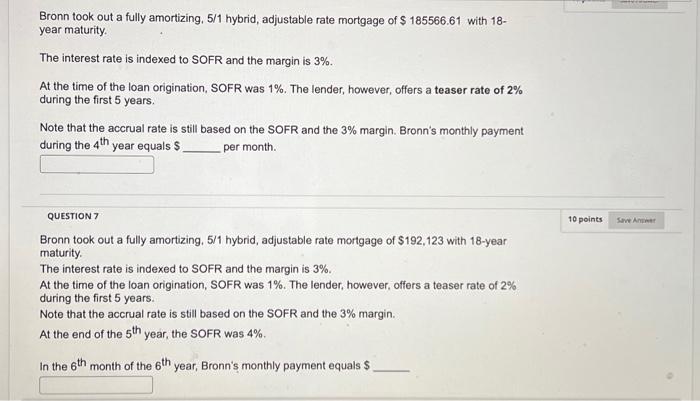

Bronn took out a fully amortizing, 5/1 hybrid, adjustable rate mortgage of $185566.61 with 18 year maturity. The interest rate is indexed to SOFR and the margin is 3%. At the time of the loan origination, SOFR was 1%. The lender, however, offers a teaser rate of 2% during the first 5 years. Note that the accrual rate is still based on the SOFR and the 3% margin. Bronn's monthly payment during the 4th year equals $ per month. QUESTION 7 Bronn took out a fully amortizing, 5/1 hybrid, adjustable rate mortgage of $192,123 with 18-year maturity. The interest rate is indexed to SOFR and the margin is 3%. At the time of the loan origination, SOFR was 1%. The lender, however, offers a teaser rate of 2% during the first 5 years. Note that the accrual rate is still based on the SOFR and the 3% margin. At the end of the 5th year, the SOFR was 4%. In the 6th month of the 6th year, Bronn's monthly payment equals $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts