Question: Bruce & Co. expects its EBIT to be $140,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and

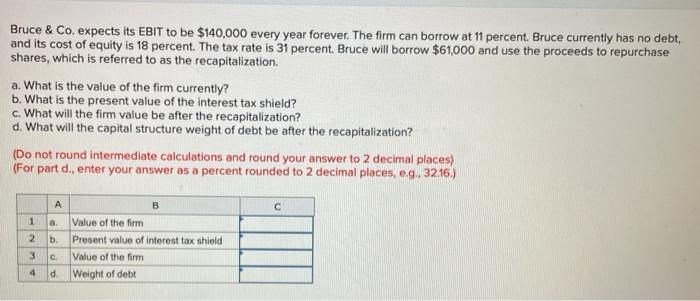

Bruce & Co. expects its EBIT to be $140,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Bruce will borrow $61,000 and use the proceeds to repurchase shares, which is referred to as the recapitalization. a. What is the value of the firm currently? b. What is the present value of the interest tax shield? c. What will the firm value be after the recapitalization? d. What will the capital structure weight of debt be after the recapitalization? (Do not round intermediate calculations and round your answer to 2 decimal places) (For part d., enter your answer as a percent rounded to 2 decimal places, e9.. 32.16.) B a. 1 2 3 b. Value of the firm Present value of interest tax shield Value of the firm Weight of debt C 4 d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts