Question: Bryant leased equipment that had a retail cash selling price of $750,000 and a useful life of six years with no residual value. The lessor

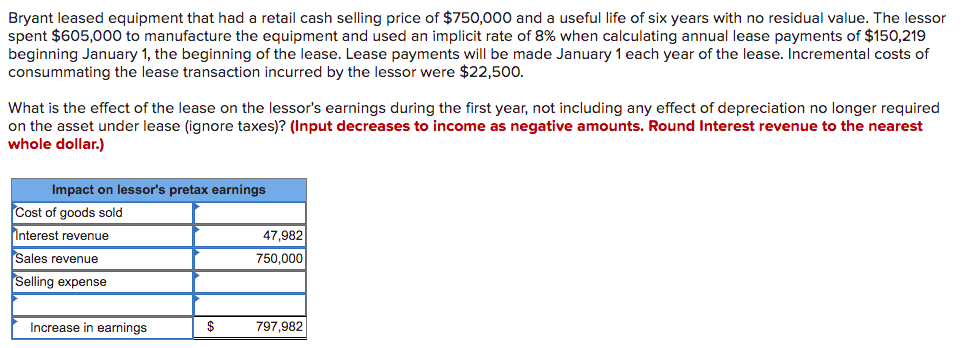

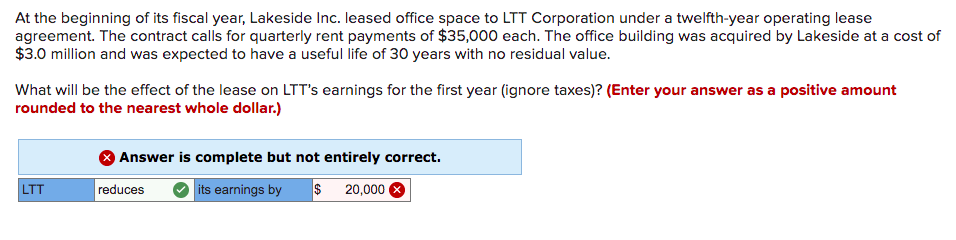

Bryant leased equipment that had a retail cash selling price of $750,000 and a useful life of six years with no residual value. The lessor spent $605,000 to manufacture the equipment and used an implicit rate of 8% when calculating annual lease payments of $150,219 beginning January 1, the beginning of the lease. Lease payments will be made January 1 each year of the lease. Incremental costs of consummating the lease transaction incurred by the lessor were $22,500. What is the effect of the lease on the lessor's earnings during the first year, not including any effect of depreciation no longer required on the asset under lease (ignore taxes)? (Input decreases to income as negative amounts. Round Interest revenue to the nearest whole dollar.) Impact on lessor's pretax earnings Cost of goods sold Interest revenue 47,982 Sales revenue 750,000 Selling expense Increase in earnings $ 797,982 At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a twelfth-year operating lease agreement. The contract calls for quarterly rent payments of $35,000 each. The office building was acquired by Lakeside at a cost of $3.0 million and was expected to have a useful life of 30 years with no residual value. What will be the effect of the lease on LTT's earnings for the first year (ignore taxes)? (Enter your answer as a positive amount rounded to the nearest whole dollar.) Answer is complete but not entirely correct. reduces its earnings by $ 20,000 LTT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts