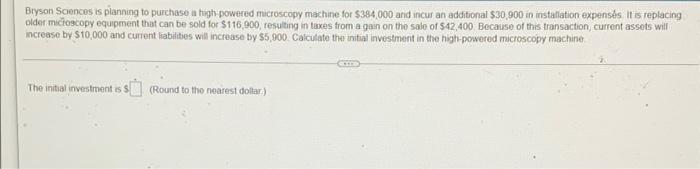

Question: Bryson Sciences is planning to purchase a high powered microscopy machine for $384.000 and incur an additional $30,900 in installation expenses. It is replacing older

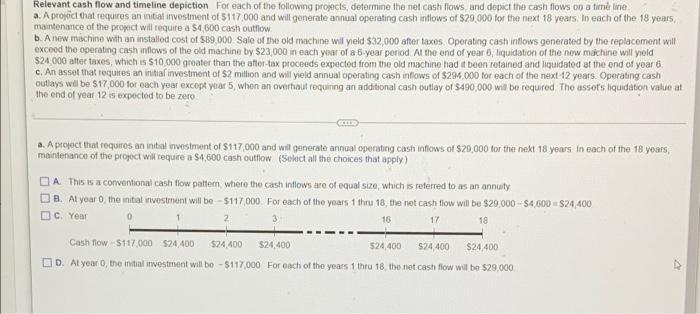

Bryson Sciences is planning to purchase a high powered microscopy machine for $384.000 and incur an additional $30,900 in installation expenses. It is replacing older microscopy equipment that can be sold for $116,900, resulting in taxes from again on the sale of 542,400 Because of this transaction, current assets will increase by $10,000 and current liabilities will increase by $5,900 Calculato the initial investment in the high-powered microscopy machine The initial investments (Round to the nearest dolar) Relevant cash flow and timeline depiction For each of the following promocis, determine the net cash flows and depict the cash flows on a timeline a. A projice that requires an initial investment of 5117,000 and wil generate annual operating cash intlows of S29,000 for the next 18 years. In each of the 18 years, maintenance of the project will require a $4,600 cash outflow b. A new machine with an installed cost of $89.000. Sale of the old machine will yield $32,000 after taxes Operating cash inflows generated by the replacement will exceed the operating cash flows of the old machine by $23,000 in each year of a 6 year period At the end of year 6, liquidation of the new machine will yield $24.000 after taxes, which is $10.000 greater than the after tax proceeds expected from the old machine had it been retained and liquidated at the end of year 6 c. An asset that requires an initial investment of 52 million and will yield annual operating cash inflows of $294.000 for each of the next 12 years. Operating cash outlays will be $17,000 for each year except yuar 5, when an overtinut requiring an additional cash outlay of $490,000 will be required. The asset's liquidation value at the end of year 12 is expected to be zero a. A project that requires an initial investment of 117,000 and wil generate annual operating cast inflows of $20,000 for the next 18 years in each of the 18 years maintenance of the project will require a $4,600 cash outflow (Select all the choices that apply) CA This is a conventional cash flow pattern, where the cash inflows ture of equal size, which is referred to as an annuity B. Al year o the initial investront will be - $117.000 For each of the yours 1 thru 18, the net cash flow will be $29,000 - 54,600 $24.400 D C Year 16 17 18 Cash flow 5117,000 $24.400 $24.400 $24,400 524.400 S24.400 $24.400 D. At year, the initial investment will be - $117.000 For each of the years thru 18. the net cash flow will be $29.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts