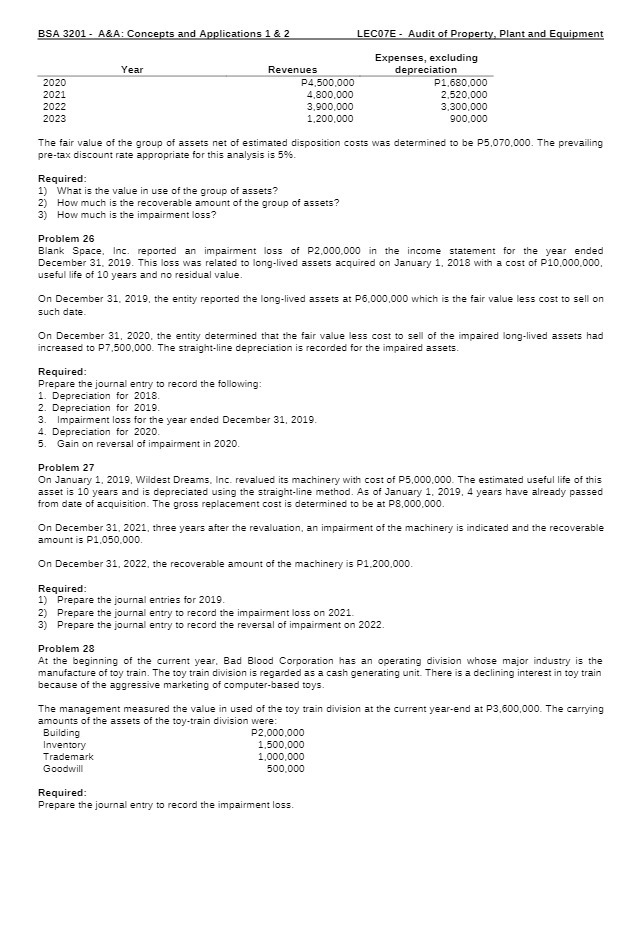

Question: BSA 3201 - A&A: Concepts and Applications 1 & 2 LECOTE - Audit of Property, Plant and Equipment Expenses, excluding Year Revenues depreciation 2020 P4,500,000

BSA 3201 - A&A: Concepts and Applications 1 & 2 LECOTE - Audit of Property, Plant and Equipment Expenses, excluding Year Revenues depreciation 2020 P4,500,000 P1.680,000 2021 4,800,000 2.520,000 2022 3,900,000 3.300.000 2023 1,200.000 900.000 The fair value of the group of assets net of estimated disposition costs was determined to be P5,070,000. The prevailing pre-tax discount rate appropriate for this analysis is 5% Required: 1) What is the value in use of the group of assets? How much is the recoverable amount of the group of assets? How much is the impairment loss? Problem 26 Blank Space. Inc. reported an impairment loss of P2,000.000 in the income statement for the year ended December 31, 2019. This loss was related to long-lived assets acquired on January 1, 2018 with a cost of P10,000,000, useful life of 10 years and no residual value. On December 31, 2019, the entity reported the long-lived assets at P6,000,000 which is the fair value less cost to sell on such date On December 31, 2020, the entity determined that the fair value less cost to sell of the impaired long-lived assets had increased to P7,500.000. The straight-line depreciation is recorded for the impaired assets. Required: Prepare the journal entry to record the following: Depreciation for 2018. Depreciation for 2019. W ! Impairment loss for the year ended December 31, 2019. Depreciation for 2020. Gain on reversal of impairment in 2020. Problem 27 On January 1, 2019, Wildest Dreams, Inc. revalued its machinery with cost of P5,000,000. The estimated useful life of this asset is 10 years and is depreciated using the straight-line method. As of January 1, 2019, 4 years have already passed from date of acquisition. The gross replacement cost is determined to be at P8,000,000. On December 31, 2021, three years after the revaluation, an impairment of the machinery is indicated and the recoverable amount is P1,050,000. On December 31, 2022, the recoverable amount of the machinery is P1,200,000. Required: 1) Prepare the journal entries for 2019. Prepare the journal entry to record the impairment loss on 2021. Prepare the journal entry to record the reversal of impairment on 2022. Problem 28 At the beginning of the current year, Bad Blood Corporation has an operating division whose major industry is the manufacture of toy train. The toy train division is regarded as a cash generating unit. There is a declining interest in toy train because of the aggressive marketing of computer-based toys The management measured the value in used of the toy train division at the current year-end at P3,600,000. The carrying amounts of the assets of the toy-train division were: Building P2,000,000 Inventory 1,500,000 Trademark 1,000,000 Goodwill 500.000 Required: Prepare the journal entry to record the impairment loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts