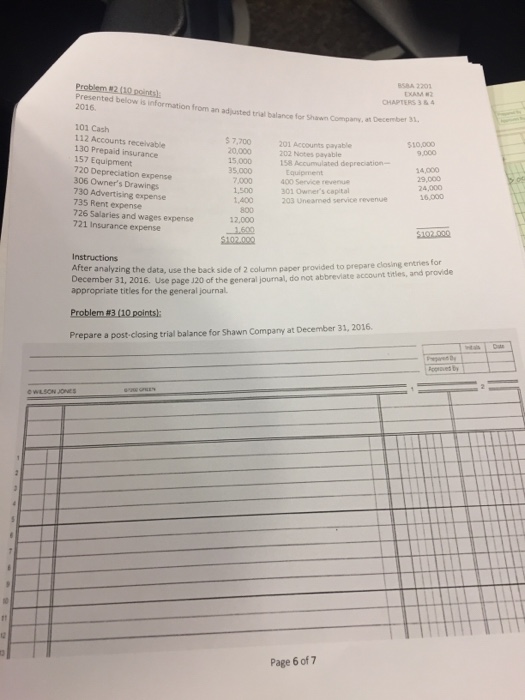

Question: BSBA 2201 Presented below is information from an adjusted trial balance for Shawn Company 2016 CHAPTERS 3 &4 at December 31 101 Cash 112 Accounts

BSBA 2201 Presented below is information from an adjusted trial balance for Shawn Company 2016 CHAPTERS 3 &4 at December 31 101 Cash 112 Accounts recelvable 130 Prepaid insurance 157 Equipment 720 Depreciation expense 306 Owner's Drawings 730 Advertising expense 735 Rent expense 726 Salaries and wages expense 721 Insurance expense $7,700 20,000 201 Accounts payable 202 Notes payable 510,000 9,000 15,000 158 Acumulated depreciation 35,000 7,000 1,500 1,400 800 12,000 14,000 29,000 24,000 CO Serve reverue 301 Owner's capital 203 Unearmed service revenue 16,000 Instructions After analyzing the data, use the back side December 31, 2016. Use page J2 appropriate titles for the general journal. of 2 column paper provided to prepare closing entries for 0 of the general journal, do not abbreviate account titles, and provide Prepare a post closing trial balance for Shawn Company at December 31, 2016. WLSON JONES Page 6 of 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts