Question: BTEM2014 LAND ECONOMICS SECTION B: Answer only one question Question 5 Kayson is an aggressive investor seeking opportunity for excess return from real estate development

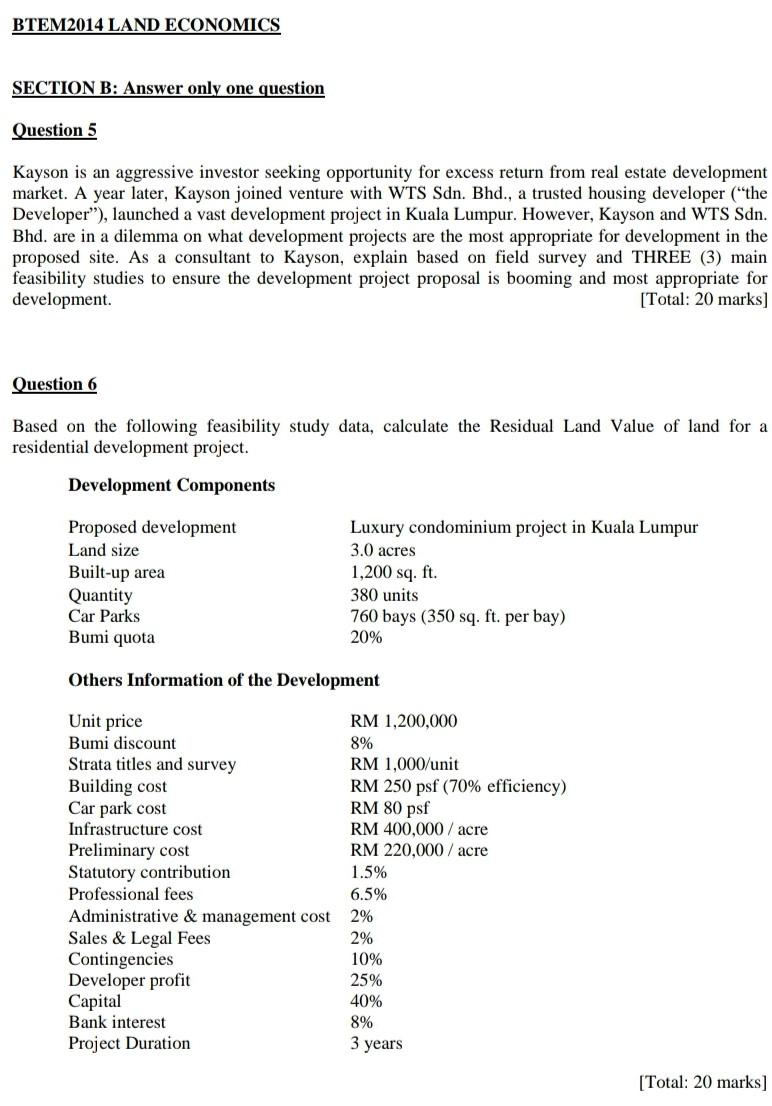

BTEM2014 LAND ECONOMICS SECTION B: Answer only one question Question 5 Kayson is an aggressive investor seeking opportunity for excess return from real estate development market. A year later, Kayson joined venture with WTS Sdn. Bhd., a trusted housing developer ("the Developer"), launched a vast development project in Kuala Lumpur. However, Kayson and WTS Sdn. Bhd. are in a dilemma on what development projects are the most appropriate for development in the proposed site. As a consultant to Kayson, explain based on field survey and THREE (3) main feasibility studies to ensure the development project proposal is booming and most appropriate for development [Total: 20 marks) Question 6 Based on the following feasibility study data, calculate the Residual Land Value of land for a residential development project. Development Components Proposed development Land size Built-up area Quantity Car Parks Luxury condominium project in Kuala Lumpur 3.0 acres 1,200 sq. ft. 380 units 760 bays (350 sq. ft. per bay) 20% Bumi quota Others Information of the Development Unit price Bumi discount Strata titles and survey Building cost Car park cost Infrastructure cost Preliminary cost Statutory contribution Professional fees Administrative & management cost Sales & Legal Fees Contingencies Developer profit Capital Bank interest Project Duration RM 1,200,000 8% RM 1,000/unit RM 250 psf (70% efficiency) RM 80 psf RM 400,000/acre RM 220,000/acre 1.5% 6.5% 2% 2% 10% 25% 40% 8% 3 years [Total: 20 marks] BTEM2014 LAND ECONOMICS SECTION B: Answer only one question Question 5 Kayson is an aggressive investor seeking opportunity for excess return from real estate development market. A year later, Kayson joined venture with WTS Sdn. Bhd., a trusted housing developer ("the Developer"), launched a vast development project in Kuala Lumpur. However, Kayson and WTS Sdn. Bhd. are in a dilemma on what development projects are the most appropriate for development in the proposed site. As a consultant to Kayson, explain based on field survey and THREE (3) main feasibility studies to ensure the development project proposal is booming and most appropriate for development [Total: 20 marks) Question 6 Based on the following feasibility study data, calculate the Residual Land Value of land for a residential development project. Development Components Proposed development Land size Built-up area Quantity Car Parks Luxury condominium project in Kuala Lumpur 3.0 acres 1,200 sq. ft. 380 units 760 bays (350 sq. ft. per bay) 20% Bumi quota Others Information of the Development Unit price Bumi discount Strata titles and survey Building cost Car park cost Infrastructure cost Preliminary cost Statutory contribution Professional fees Administrative & management cost Sales & Legal Fees Contingencies Developer profit Capital Bank interest Project Duration RM 1,200,000 8% RM 1,000/unit RM 250 psf (70% efficiency) RM 80 psf RM 400,000/acre RM 220,000/acre 1.5% 6.5% 2% 2% 10% 25% 40% 8% 3 years [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts