Question: BTN 9 - 2 . Comparative Analysis Problem: Columbia Sportswear Company vs Under Armour Inc. The financial statements for the Columbia Sportswear Company can be

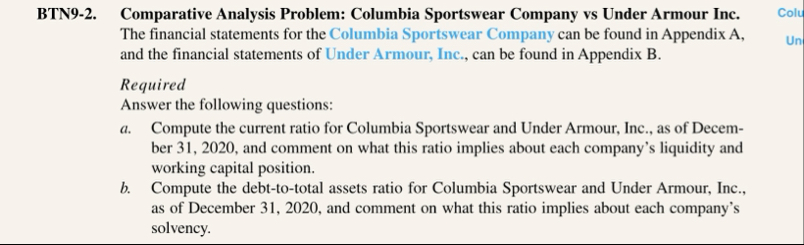

BTN Comparative Analysis Problem: Columbia Sportswear Company vs Under Armour Inc.

The financial statements for the Columbia Sportswear Company can be found in Appendix A and the financial statements of Under Armour, Inc., can be found in Appendix B

Required

Answer the following questions:

a Compute the current ratio for Columbia Sportswear and Under Armour, Inc., as of December and comment on what this ratio implies about each company's liquidity and working capital position.

b Compute the debttototal assets ratio for Columbia Sportswear and Under Armour, Inc., as of December and comment on what this ratio implies about each company's solvency.COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED BALANCE SHEETS

December

in thousands

ASSETS

Current Assets:

Cash and cash equivalents

Shortterm investments

Accounts receivable, net of allowance of $ and $ respectively

Inventories, net

Prepaid expenses and other current assets

Total current assets

Property, plant and equipment, net

Operating lease rightofuse assets

Intangible assets, net

Goodwill

Deferred income taxes

Other noncurrent assets

Total assets

LIABILITIES AND EQUITY

Current Liabilities:

tableAccounts payable,$$Accrued liabilities,,Operating lease liabilities,,Income taxes payable,,Total current liabilities,,Noncurrent operating lease liabilities,,Income taxes payable,,Deferred income taxes,,Other longterm liabilities,,Total liabilities,,Commitments and contingencies Note Shareholders Equity.,,,,Preferred slock; shares authorized; none issued and outstanding,,Common stock no par value; shares authorized; and issued and outstanding, respectively,,Retained earnings,,Accumulated other comprehensive income lossTotal shareholders' equity,,Total liabilities and shareholders' equity,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock