Question: BUAD 1 1 1 Project - Part 2 Here is the second part of your Take Me Somewhere Warm, Inc transactions. In this part, you

BUAD Project Part

Here is the second part of your Take Me Somewhere Warm, Inc transactions. In this part, you will complete the year end adjusting entries and bank reconciliation.

The following information is provided regarding the required adjusting entries and bank reconciliation.

The business has the following unadjusted trial balance as at December :

Take Me Somewhere Warm, Inc.

Adjusted trial balance

December

tableCashAccounts receivableInventorySuppliesEquipmentAccumulated depreciationAccounts payableUnearned revenueWages payableInterest payableNotes payableOwner, capitalOwner, drawingsSales revenueCost of goods soldAdvertising expenseDepreciation expenseInterest & bank charges

tableDebitCredit

Ask Copilot

of

tableUnearned revenue,,Wages payable,,Interest payable,,Notes payable,,Owner, capital,,Owner, drawings,Sales revenue,,Cost of goods sold,Advertising expense,Depreciation expense,Interest & bank charges,Repairs expense,Supplies expense,Telephone expense,Wages expense,Totals,

Instructions

a Journalize the adjusting journahentries described in the information given on the next page. Use the general journal sheet in the forms document

b Prepare a bank reconciliation so that you can make your final adjusting journal

c Journalize the adjusting journal entry resulting from the bank reconciliation.

Adjusting journal entries at December :

Depreciation expense on the equipment for December has been correctly calculated to be $

The supplies were counted and costed out on December The were $ of office supplies remaining.

days of interest expense has accrued on the note payable and must be recorded. The annual interest rate is Round the interest amount to the nearest full dollar.

All of the unearned revenue has been earned. Hint: Your credit should be to Sales Revenue

Your casual worker worked on December and and will be paid $ cash on Janualy

Your final adjusting entry will be to record the bank reconciling items. First, you will have to reconcile the bank account. The information you need is below.

See details for bank reconciliation on the next page.

Previous Month's Bank Reconciliation at Nov.

Bank balance

Add: os deposit

Less: os cheques

Reconciled balance

GL Cash balance

Less: Bank service charge

Reconciled balance

#

#

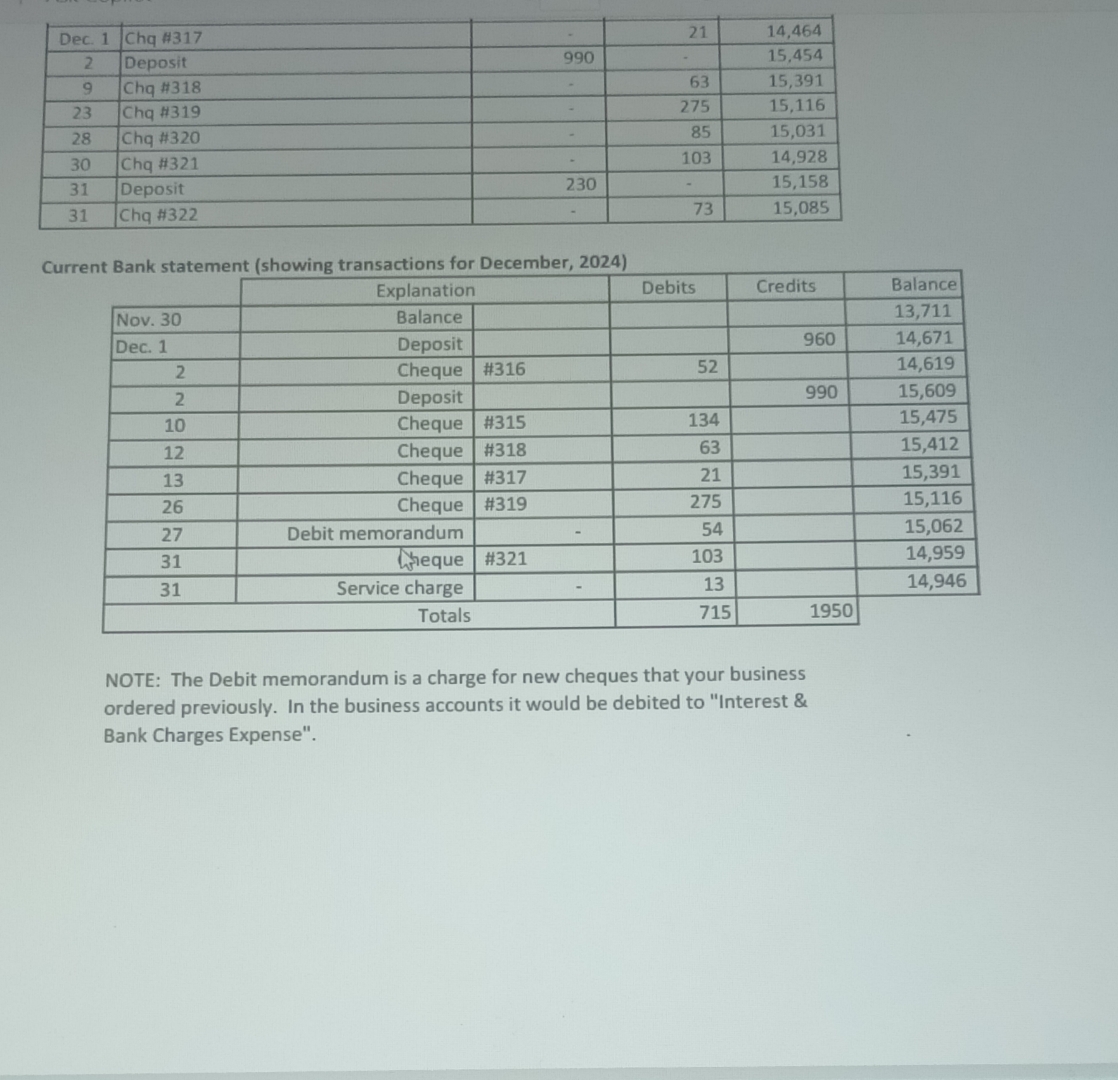

tableCash General Ledger,DateAcct #Nov Bal. forward,Debit,Credit,BalanceDecChq #Deposit,Chq #Chq #Chq #Chq #Deposit,Chq #

Current Bank statement showing transactions for December,

tableExplanation,Debits,Credits,BalanceNovBalance,,,,DecDeposit,,,Cheque,#Deposit,,,Cheque,#Cheque,#Cheque,#Cheque,#

Search

tableDecChq #Deposit,Chq #Chq #Chq #Chq #Deposit,Chq #

Current Bank statement showing transactions for December,

tableExplanation,Debits,Credits,BalanceNovBalance,,,,DecDeposit,,,Cheque,#Deposit,,,Cheque,#Cheque,#Cheque,#Cheque,#Debit memorandum,Weque,#Service charge,Totals

NOTE: The Debit memorandum is a charge for new cheques that your business ordered previously. In the business accounts it would be debited to "Interest & Bank Charges Expense".

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock