Question: Bubba bubblegum is considering a project that has the following cash flows: How do you find the initial investment? Please show all work. Harbuck's Coffee

Bubba bubblegum is considering a project that has the following cash flows:

How do you find the initial investment? Please show all work.

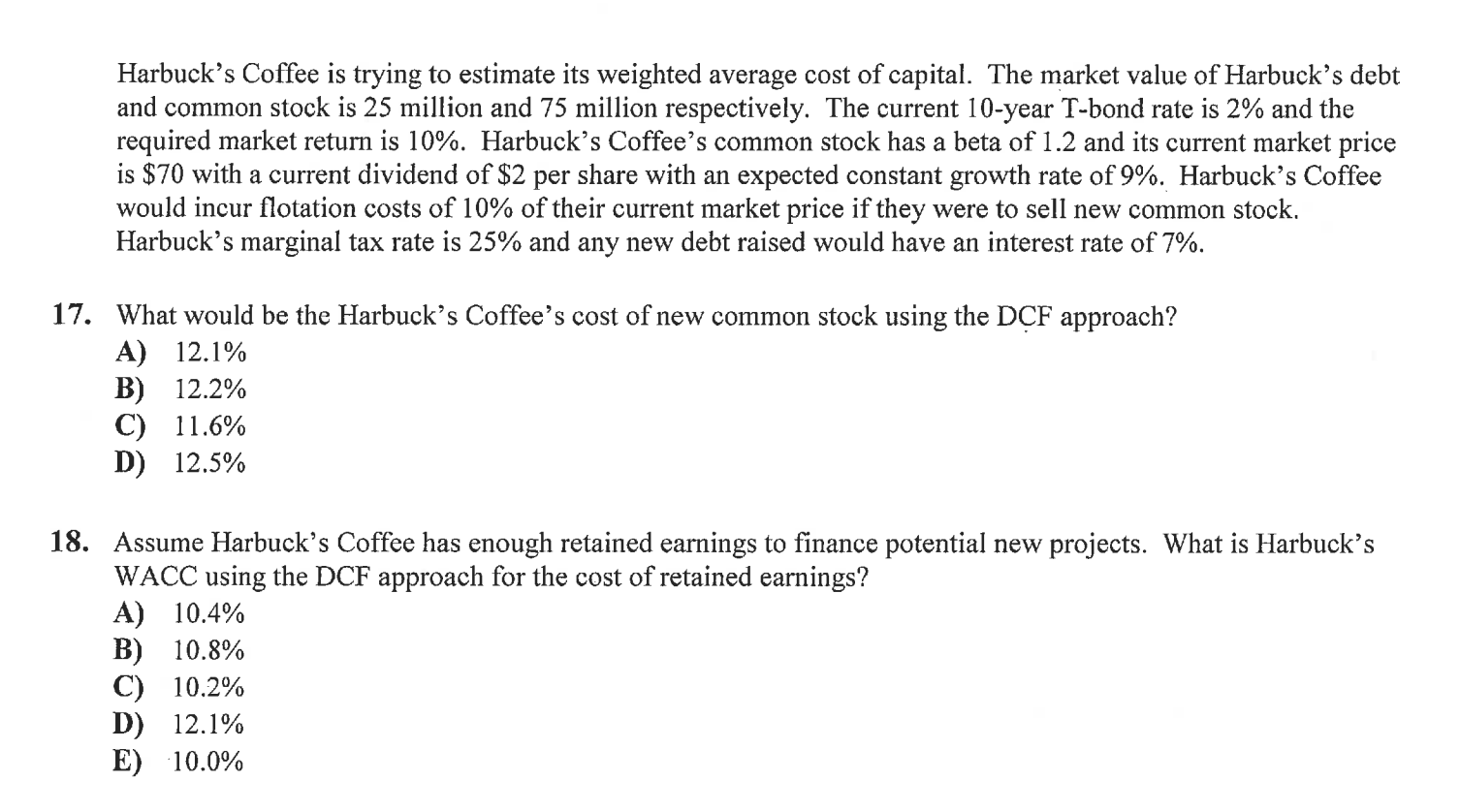

Harbuck's Coffee is trying to estimate its weighted average cost of capital. The market value of Harbuck's debt and common stock is 25 million and 75 million respectively. The current 10-year T-bond rate is 2% and the required market return is 10%. Harbuck's Coffee's common stock has a beta of 1.2 and its current market price is $70 with a current dividend of $2 per share with an expected constant growth rate of 9%. Harbuck's Coffee would incur flotation costs of 10% of their current market price if they were to sell new common stock. Harbuck's marginal tax rate is 25% and any new debt raised would have an interest rate of 7%. 17. What would be the Harbuck's Coffee's cost of new common stock using the DCF approach? A) 12.1% B) 12.2% C) 11.6% D) 12.5% 18. Assume Harbuck's Coffee has enough retained earnings to finance potential new projects. What is Harbuck's WACC using the DCF approach for the cost of retained earnings? A) 10.4% B) 10.8% C) 10.2% D) 12.1% E) 10.0% Harbuck's Coffee is trying to estimate its weighted average cost of capital. The market value of Harbuck's debt and common stock is 25 million and 75 million respectively. The current 10-year T-bond rate is 2% and the required market return is 10%. Harbuck's Coffee's common stock has a beta of 1.2 and its current market price is $70 with a current dividend of $2 per share with an expected constant growth rate of 9%. Harbuck's Coffee would incur flotation costs of 10% of their current market price if they were to sell new common stock. Harbuck's marginal tax rate is 25% and any new debt raised would have an interest rate of 7%. 17. What would be the Harbuck's Coffee's cost of new common stock using the DCF approach? A) 12.1% B) 12.2% C) 11.6% D) 12.5% 18. Assume Harbuck's Coffee has enough retained earnings to finance potential new projects. What is Harbuck's WACC using the DCF approach for the cost of retained earnings? A) 10.4% B) 10.8% C) 10.2% D) 12.1% E) 10.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts