Question: Consider an incomplete market framework with overlapping generations such as in Paul Samuelson's pioneering contribution. Specifically assume the following: there are two commodities, labor

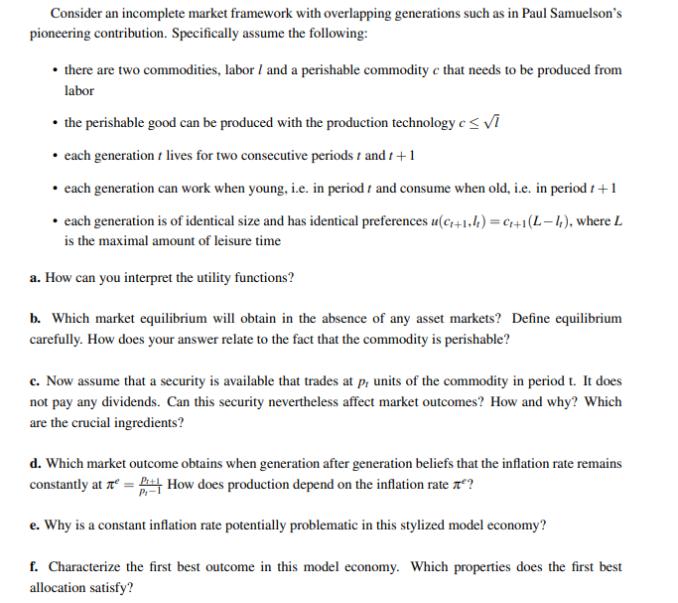

Consider an incomplete market framework with overlapping generations such as in Paul Samuelson's pioneering contribution. Specifically assume the following: there are two commodities, labor I and a perishable commodity e that needs to be produced from labor the perishable good can be produced with the production technology c < each generation / lives for two consecutive periods 1 and 1+1 each generation can work when young, i.e. in period r and consume when old, i.e. in period 1+1 each generation is of identical size and has identical preferences u(c++1.4)=C+1(L-1), where L is the maximal amount of leisure time a. How can you interpret the utility functions? b. Which market equilibrium will obtain in the absence of any asset markets? Define equilibrium carefully. How does your answer relate to the fact that the commodity is perishable? c. Now assume that a security is available that trades at p, units of the commodity in period t. It does not pay any dividends. Can this security nevertheless affect market outcomes? How and why? Which are the crucial ingredients? d. Which market outcome obtains when generation after generation beliefs that the inflation rate remains constantly at = How does production depend on the inflation rate ? e. Why is a constant inflation rate potentially problematic in this stylized model economy? f. Characterize the first best outcome in this model economy. Which properties does the first best allocation satisfy?

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

a Interpretation of Utility Functions The utility function uct1 L represents the preferences of each generation where ct1 is the consumption in the se... View full answer

Get step-by-step solutions from verified subject matter experts