Question: Budgeting Workseets. Thanks :) Data in 1st image and rough formatting in the 2nd image B C D E F G H M O P

Budgeting Workseets. Thanks :) Data in 1st image and rough formatting in the 2nd image

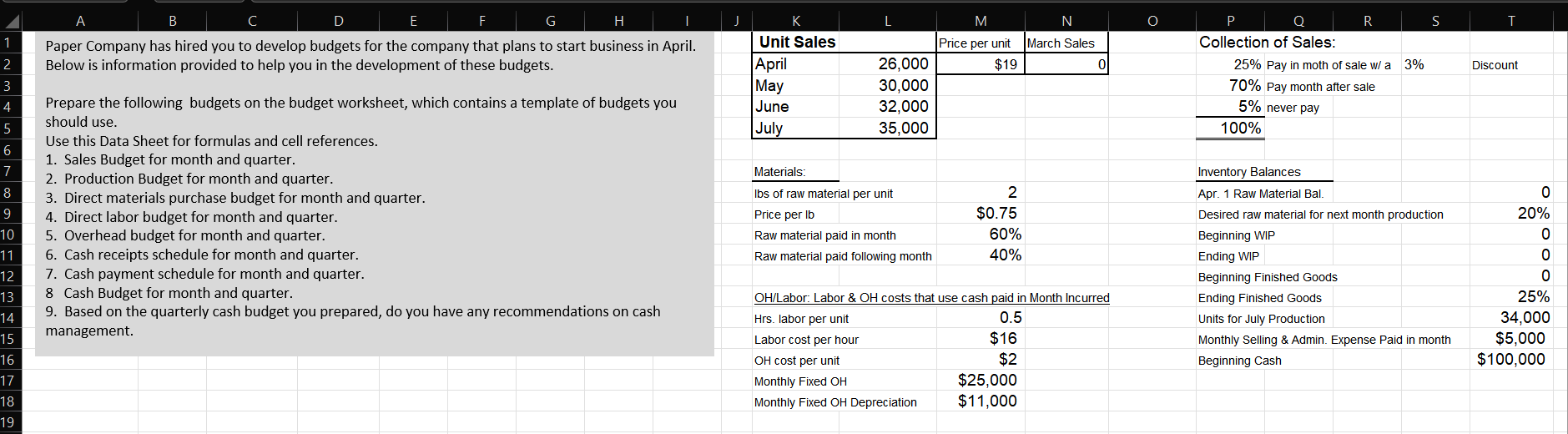

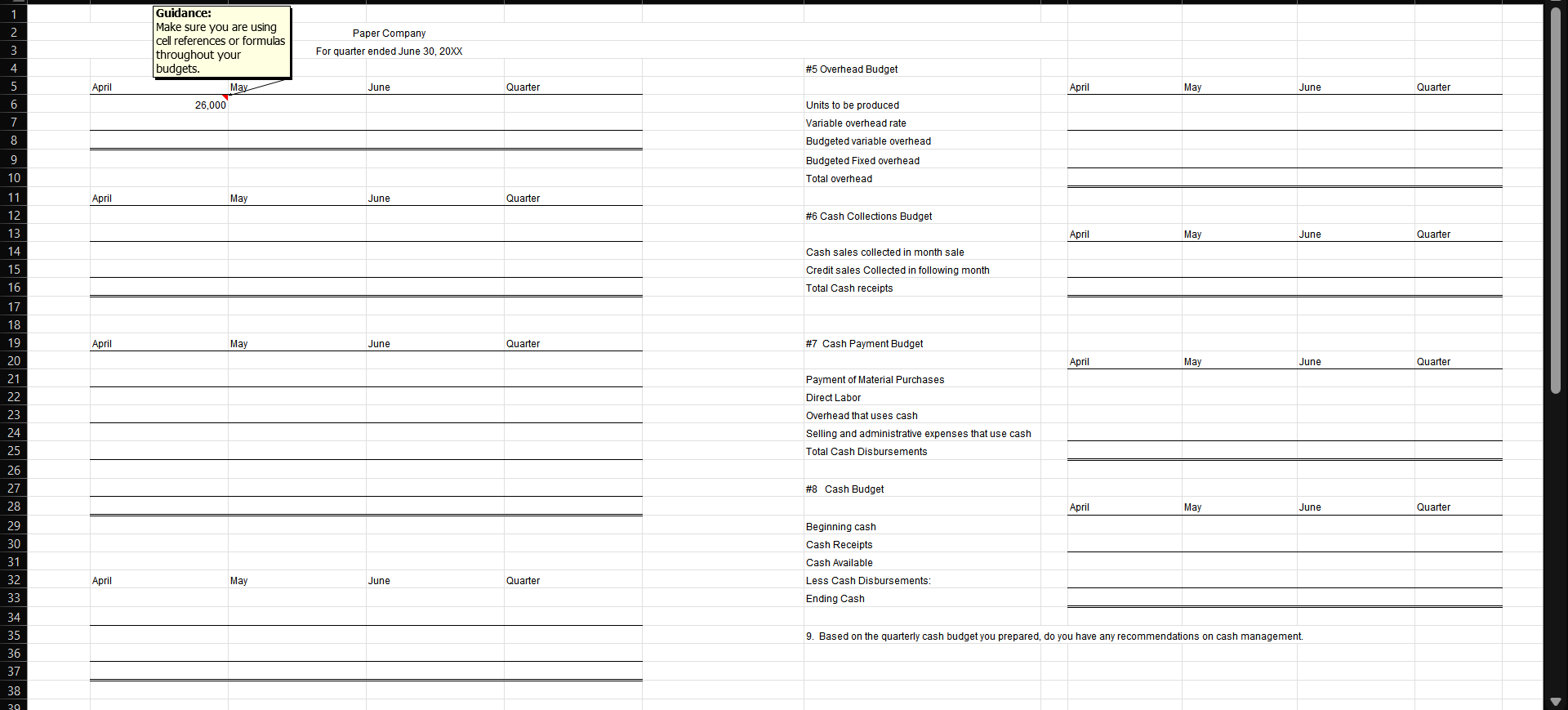

B C D E F G H M O P Q R S Paper Company has hired you to develop budgets for the company that plans to start business in April. Unit Sales Price per unit March Sales Collection of Sales Below is information provided to help you in the development of these budgets. April 26,000 $19 25% Pay in moth of sale w/ a 3% Discount May 30,000 70% Pay month after sale Prepare the following budgets on the budget worksheet, which contains a template of budgets you June 32,000 5% never pay should use. July 35,000 100% 6 Use this Data Sheet for formulas and cell references. 1. Sales Budget for month and quarter. Materials: Inventory Balances 2. Production Budget for month and quarter. Ibs of raw material per unit 2 0 3. Direct materials purchase budget for month and quarter. Apr. 1 Raw Material Bal. 4. Direct labor budget for month and quarter. Price per lb $0.75 Desired raw material for next month production 20% 10 5. Overhead budget for month and quarter. Raw material paid in month 60% Beginning WIP 0 6. Cash receipts schedule for month and quarter. Raw material paid following month 40% Ending WIP 0 7. Cash payment schedule for month and quarter. Beginning Finished Goods 0 13 8 Cash Budget for month and quarter. OH/Labor: Labor & OH costs that use cash paid in Month Incurred Ending Finished Goods 25% 4 9. Based on the quarterly cash budget you prepared, do you have any recommendations on cash Hrs. labor per unit 0.5 Units for July Production 34,000 15 management. Labor cost per hour $16 Monthly Selling & Admin. Expense Paid in month $5,000 16 OH cost per unit $2 Beginning Cash $100,000 Monthly Fixed OH $25,000 18 Monthly Fixed OH Depreciation $11,000Guidance: Make sure you are using Paper Company cell references or formulas throughout your For quarter ended June 30, 20Xx budgets #5 Overhead Budget May June Quarter April May June Quarter April 26,000 Units to be produced Variable overhead rate 8 Budgeted variable overhead Budgeted Fixed overhead 10 Total overhead April May June Quarter #6 Cash Collections Budget May June 13 April Quarter Cash sales collected in month sale 15 Credit sales Collected in following month 16 Total Cash receipts 17 18 19 April May June Quarter #7 Cash Payment Budget April May June Quarter Payment of Material Purchases Direct Labor Overhead that uses cash Selling and administrative expenses that use cash Total Cash Disbursements #8 Cash Budget April May June Quarter 29 Beginning cash 30 Cash Receipts 31 Cash Available 32 April May June Quarter Less Cash Disbursements: 33 Ending Cash 34 35 9. Based on the quarterly cash budget you prepared, do you have any recommendations on cash management. 36 37 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts