Question: Build a classification model that classifies customers based on their default risk. Then answer the following questions. 1 What is the most important factor in

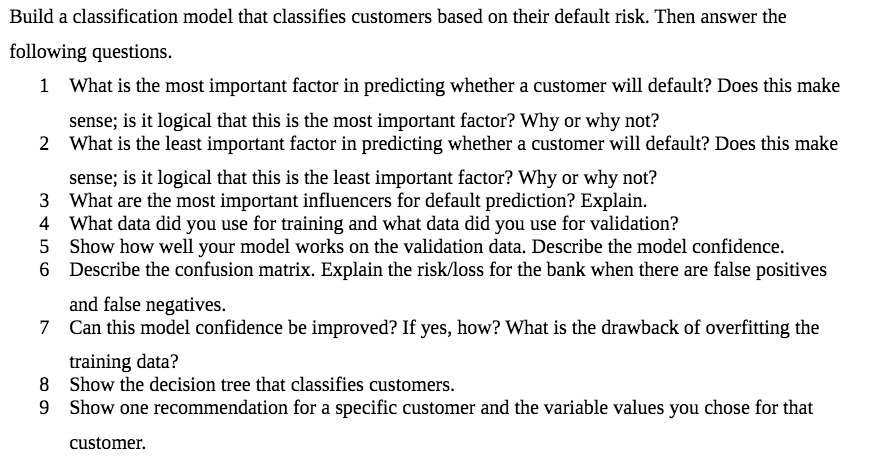

Build a classification model that classifies customers based on their default risk. Then answer the following questions. 1 What is the most important factor in predicting whether a customer will default? Does this make sense; is it logical that this is the most important factor? Why or why not? 2 What is the least important factor in predicting whether a customer will default? Does this make sense; is it logical that this is the least important factor? Why or why not? What are the most important influencers for default prediction? Explain. What data did you use for training and what data did you use for validation? 5 Show how well your model works on the validation data. Describe the model confidence. 6 Describe the confusion matrix. Explain the risk/loss for the bank when there are false positives and false negatives. 7 Can this model confidence be improved? If yes, how? What is the drawback of overfitting the training data? CO Show the decision tree that classifies customers. 6 Show one recommendation for a specific customer and the variable values you chose for that customer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts