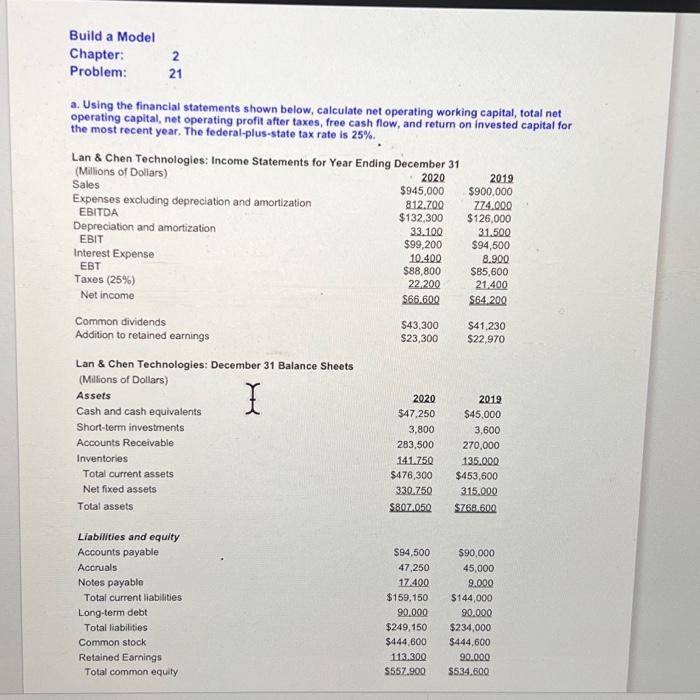

Question: Build a Model Chapter: 2 Problem: 21 a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating

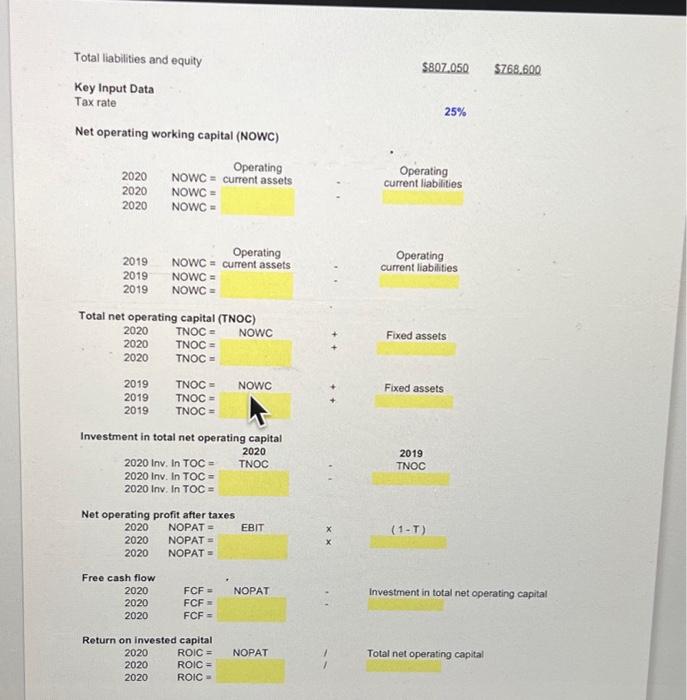

Build a Model Chapter: 2 Problem: 21 a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for the most recent year. The federal-plus-state tax rate is 25%. Lan \& Chen Technologies: December 31 Balance Sheets Total liabilities and equity $807.050$768.600 Key Input Data Tax rate 25% Net operating working capital (NOWC) 202020202020NOWC=OperatingNOWC=NOWC= 2019NOWC=currentassetsOperating2019currentliabilities2019NOWC=2019NOWC= Total net operating capital (TNOC) TNOC= Investment in total net operating capital 2020lnvlnTOC=2020lnlnTOC=2020lnvlnTOC=20202019TNOC Net operating profit after taxes 2020NOPAT= Free cash flow 2020FCF= Return on invested capital 20202020ROIC=ROIC=NOPATTotalnetoperatingcapital Build a Model Chapter: 2 Problem: 21 a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for the most recent year. The federal-plus-state tax rate is 25%. Lan \& Chen Technologies: December 31 Balance Sheets Total liabilities and equity $807.050$768.600 Key Input Data Tax rate 25% Net operating working capital (NOWC) 202020202020NOWC=OperatingNOWC=NOWC= 2019NOWC=currentassetsOperating2019currentliabilities2019NOWC=2019NOWC= Total net operating capital (TNOC) TNOC= Investment in total net operating capital 2020lnvlnTOC=2020lnlnTOC=2020lnvlnTOC=20202019TNOC Net operating profit after taxes 2020NOPAT= Free cash flow 2020FCF= Return on invested capital 20202020ROIC=ROIC=NOPATTotalnetoperatingcapital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts