Question: Build a model to analyze a stock's beta, alpha and average monthly returns. Use your model to answer the following questions: What is the

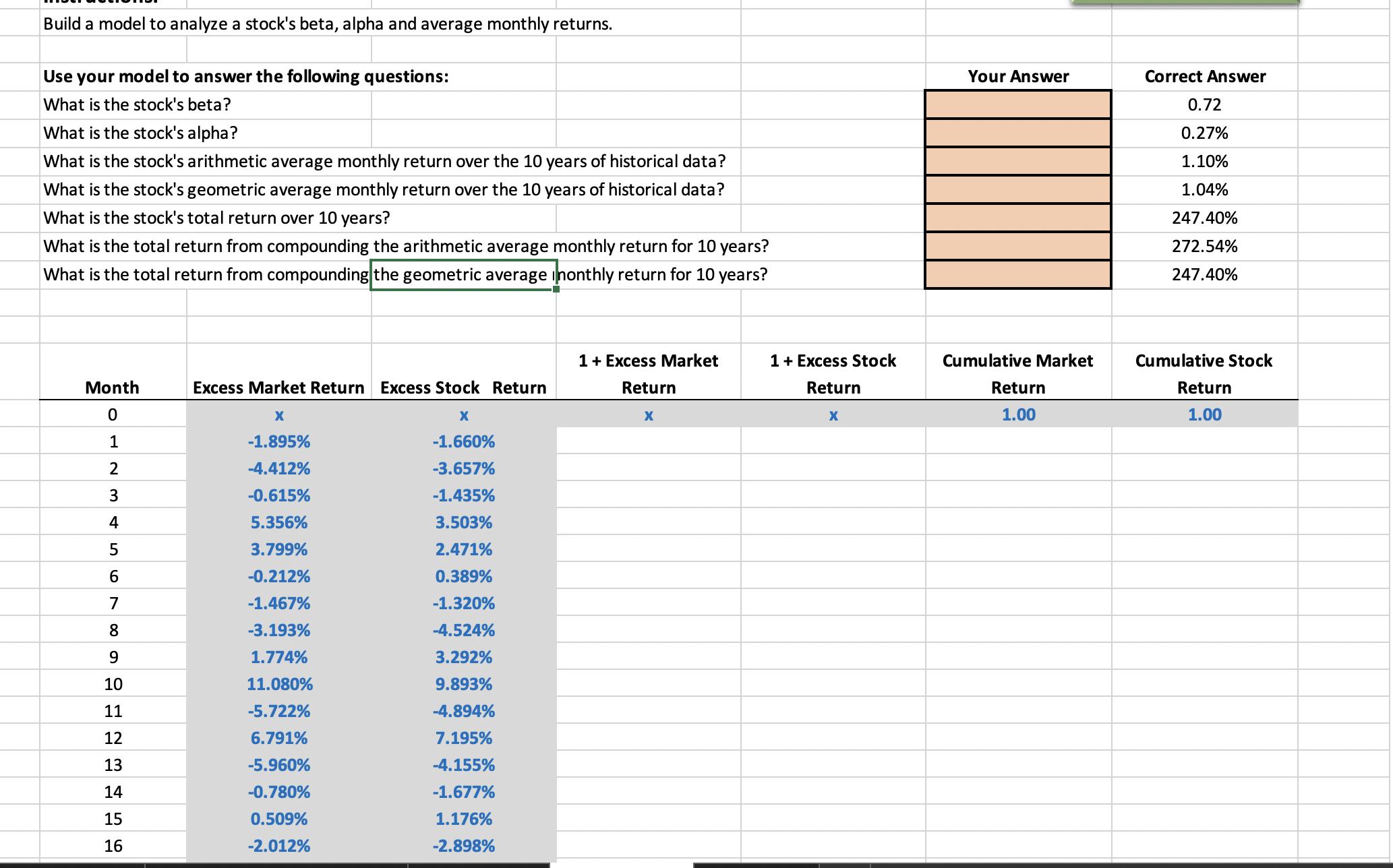

Build a model to analyze a stock's beta, alpha and average monthly returns. Use your model to answer the following questions: What is the stock's beta? What is the stock's alpha? What is the stock's arithmetic average monthly return over the 10 years of historical data? What is the stock's geometric average monthly return over the 10 years of historical data? What is the stock's total return over 10 years? What is the total return from compounding the arithmetic average monthly return for 10 years? What is the total return from compounding the geometric average monthly return for 10 years? Month 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 56 16 Excess Market Return Excess Stock Return X -1.895% -4.412% -0.615% 5.356% 3.799% -0.212% -1.467% -3.193% 1.774% 11.080% -5.722% 6.791% -5.960% -0.780% 0.509% -2.012% X -1.660% -3.657% -1.435% 3.503% 2.471% 0.389% -1.320% -4.524% 3.292% 9.893% -4.894% 7.195% -4.155% -1.677% 1.176% -2.898% 1 + Excess Market Return X 1 + Excess Stock Return X Your Answer Cumulative Market Return 1.00 Correct Answer 0.72 0.27% 1.10% 1.04% 247.40% 272.54% 247.40% Cumulative Stock Return 1.00

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

a financial model that can be used to analyze a stocks beta alpha and average monthly returns The model uses 10 years of historical data to calculate ... View full answer

Get step-by-step solutions from verified subject matter experts