Question: Build a template to calculate NPV and IRR. using excel and show formulas MMTY Inc. has developed a new server that the firm will market

Build a template to calculate NPV and IRR. using excel and show formulas

Build a template to calculate NPV and IRR. using excel and show formulas

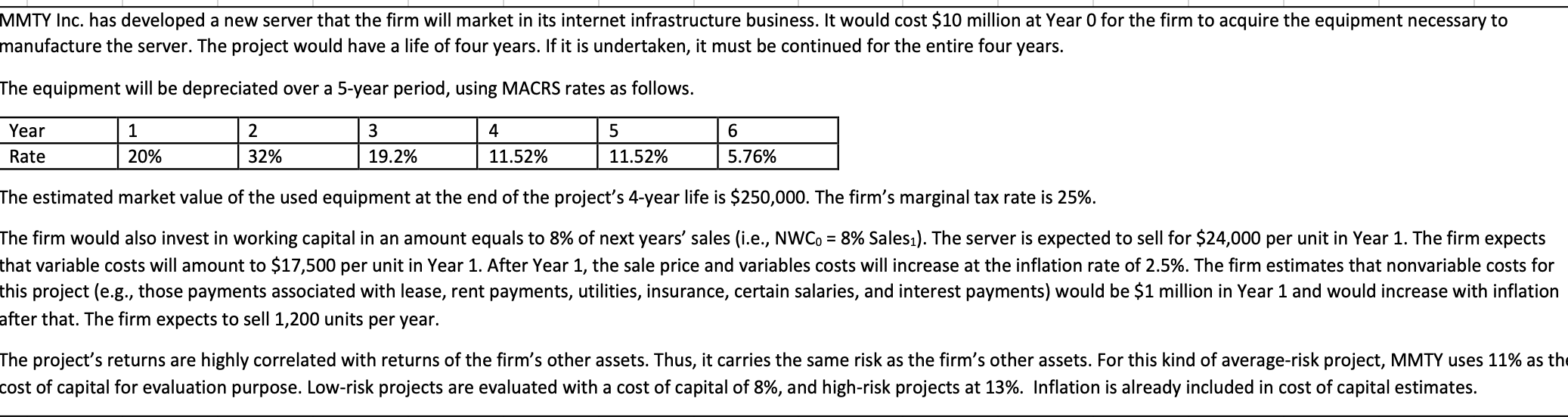

MMTY Inc. has developed a new server that the firm will market in its internet infrastructure business. It would cost $10 million at Year O for the firm to acquire the equipment necessary to manufacture the server. The project would have a life of four years. If it is undertaken, it must be continued for the entire four years. The equipment will be depreciated over a 5-year period, using MACRS rates as follows. 1 2 4 Year Rate 3 19.2% 5 11.52% 6 5.76% 20% 32% 11.52% The estimated market value of the used equipment at the end of the project's 4-year life is $250,000. The firm's marginal tax rate is 25%. The firm would also invest in working capital in an amount equals to 8% of next years' sales (i.e., NW Co = 8% Sales). The server is expected to sell for $24,000 per unit in Year 1. The firm expects that variable costs will amount to $17,500 per unit in Year 1. After Year 1, the sale price and variables costs will increase at the inflation rate of 2.5%. The firm estimates that nonvariable costs for this project (e.g., those payments associated with lease, rent payments, utilities, insurance, certain salaries, and interest payments) would be $1 million in Year 1 and would increase with inflation after that. The firm expects to sell 1,200 units per year. The project's returns are highly correlated with returns of the firm's other assets. Thus, it carries the same risk as the firm's other assets. For this kind of average-risk project, MMTY uses 11% as the cost of capital for evaluation purpose. Low-risk projects are evaluated with a cost of capital of 8%, and high-risk projects at 13%. Inflation is already included in cost of capital estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts