Question: Building Information: Unit Types: 102 Units 36 one bedroom - one bath and 66 two bedroom - 1.5 Bath Square Footage: Total square footage for

Building Information: Unit Types: 102 Units 36 one bedroom - one bath and 66 two bedroom - 1.5 Bath Square Footage: Total square footage for the complex is 88,171 Typical floor plan for the one-bedroom units totals roughly 580 SF Typical floor plan for the two-bedrooms totals roughly 860 SF.

DATA:

For all 102 units added together.

| Totals | Base Rent | RENT $55,835.00 Water $1,511.00 | Sanitary $6,354.00 |

| Annual Laundry Revenue | Approximately $6,000 - $8,000 |

(1) Sanitary income numbers are the annual totals

We recommend this loan calculator and then you can set the payment as annual and compounded annually. http://www.calculator.net/loan-calculator.html Only interest can be expensed from the income statement (not principal). Feel free to state/address your assumptions clearly with your answers, if necessary. With the information provided, please address the following problems:

Problem One: Prepare an Income statement for one year of business based on the information provided, feel free to round numbers, but do not consider depreciation in this part.

Problem Two: You purchased the property for 6 times the rental revenues. You make a down payment of 20% and the balance money is financed on a 6 year interest only loan at an interest rate of 5%. Prepare a new income statement for the first year of ownership, using a simple interest formula.

Problem Three: You purchased the property for 6 times the rental revenues, You make a down payment of 20%, however this time our loan is a 15 year at 5% interest rate, prepare a new income statement for year one, and then do the same income statement for the 15th year. Assume annual payment (you make payment at year end) and interest accrued annually.

Problem Four: Consider depreciation at 1/27th of the initial purchase price, and you purchase the property on Jan 1st . Using the information from problem three, again prepare two income statements for year one and year 15.

Problem Five: With a tax rate of 35% show how much money you save from taxes by using the depreciation deduction.

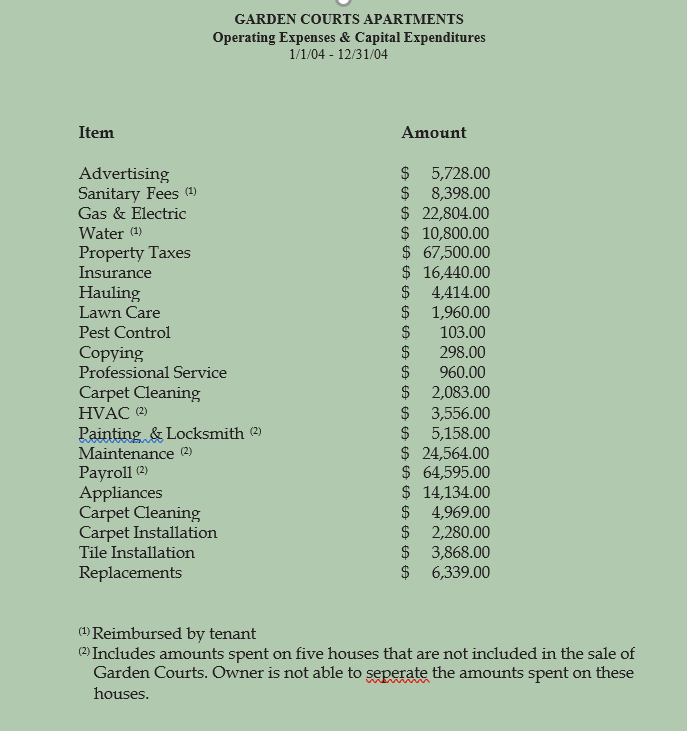

GARDEN COURTS APARTMENTS Operating Expenses & Capital Expenditures 1/1/04-12/31/04 Item Amount $ 5,728.00 $ 8,398.00 $ 22,804.00 $ 10,800.00 $ 67,500.00 $16,440.00 $ 4,414.00 1,960.00 S Advertising Sanitary Fees (1) Gas & Electric Water () Property Taxes Insurance Hauling Lawn Care 103.00 Pest Control $ Copying Professional Service 298.00 960.00 $ 2,083.00 $ 3,556.00 $ 5,158.00 Carpet Cleaning HVAC (2) Painting&Locksmith (2) Maintenance (2) Payroll Appliances Carpet Cleaning Carpet Installation 24,564.00 $ 64,595.00 $ 14,134.00 4,969.00 $ 2,280.00 3,868.00 $ (2) Tile Installation 6,339.00 Replacements (1)Reimbursed by tenant (2) Includes amounts spent on five houses that are not included in the sale of Garden Courts. Owner is not able to seperate the amounts spent on these houses. GARDEN COURTS APARTMENTS Operating Expenses & Capital Expenditures 1/1/04-12/31/04 Item Amount $ 5,728.00 $ 8,398.00 $ 22,804.00 $ 10,800.00 $ 67,500.00 $16,440.00 $ 4,414.00 1,960.00 S Advertising Sanitary Fees (1) Gas & Electric Water () Property Taxes Insurance Hauling Lawn Care 103.00 Pest Control $ Copying Professional Service 298.00 960.00 $ 2,083.00 $ 3,556.00 $ 5,158.00 Carpet Cleaning HVAC (2) Painting&Locksmith (2) Maintenance (2) Payroll Appliances Carpet Cleaning Carpet Installation 24,564.00 $ 64,595.00 $ 14,134.00 4,969.00 $ 2,280.00 3,868.00 $ (2) Tile Installation 6,339.00 Replacements (1)Reimbursed by tenant (2) Includes amounts spent on five houses that are not included in the sale of Garden Courts. Owner is not able to seperate the amounts spent on these houses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts