Question: Builtrite is considering purchasing a new machine that would cost $70,000 and the machine would be depreciated (straight line) down to $0 over its 10

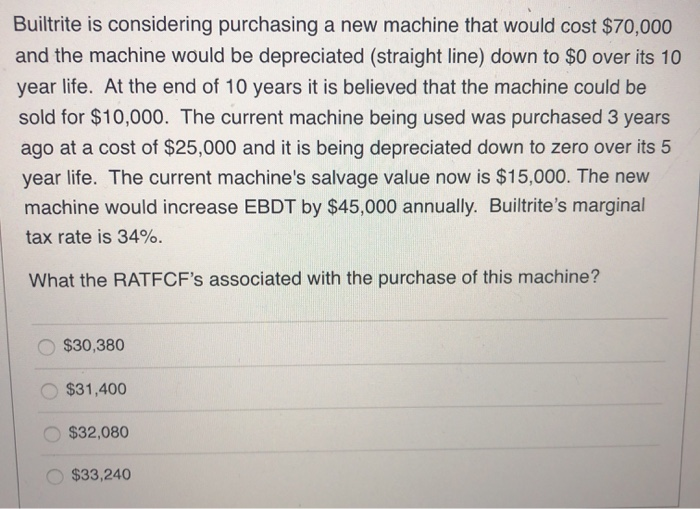

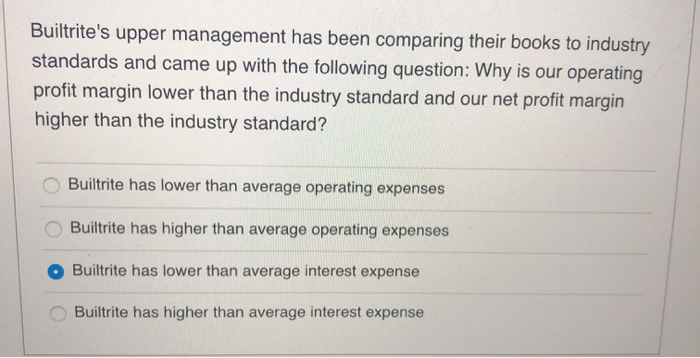

Builtrite is considering purchasing a new machine that would cost $70,000 and the machine would be depreciated (straight line) down to $0 over its 10 year life. At the end of 10 years it is believed that the machine could be sold for $10,000. The current machine being used was purchased 3 years ago at a cost of $25,000 and it is being depreciated down to zero over its 5 year life. The current machine's salvage value now is $15,000. The new machine would increase EBDT by $45,000 annually. Builtrite's marginal tax rate is 34%. What the RATFCF's associated with the purchase of this machine? $30,380 $31,400 $32,080 $33,240 Builtrite's upper management has been comparing their books to industry standards and came up with the following question: Why is our operating profit margin lower than the industry standard and our net profit margin higher than the industry standard? Builtrite has lower than average operating expenses Builtrite has higher than average operating expenses Builtrite has lower than average interest expense Builtrite has higher than average interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts