Question: Bumi Minda Sdn Bhd (BMSB) closes its account on 31 December every year. It had obtained an overdraft facility of RM400,000 from Maybank for

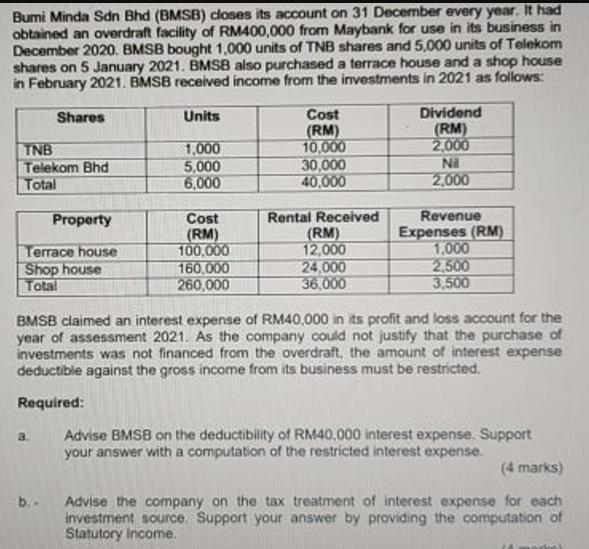

Bumi Minda Sdn Bhd (BMSB) closes its account on 31 December every year. It had obtained an overdraft facility of RM400,000 from Maybank for use in its business in December 2020. BMSB bought 1,000 units of TNB shares and 5,000 units of Telekom shares on 5 January 2021. BMSB also purchased a terrace house and a shop house in February 2021. BMSB received income from the investments in 2021 as follows: TNB Telekom Bhd Total Shares Terrace house Shop house Total a Property b.. Units 1,000 5,000 6,000 Cost (RM) 100,000 160,000 260,000 Cost (RM) 10,000 30,000 40,000 Rental Received (RM) 12,000 24,000 36,000 Dividend (RM) 2,000 Nil 2,000 BMSB claimed an interest expense of RM40,000 in its profit and loss account for the year of assessment 2021. As the company could not justify that the purchase of investments was not financed from the overdraft, the amount of interest expense deductible against the gross income from its business must be restricted. Required: Revenue Expenses (RM) 1,000 2,500 3,500 Advise BMSB on the deductibility of RM40.000 interest expense. Support your answer with a computation of the restricted interest expense. (4 marks) Advise the company on the tax treatment of interest expense for each investment source. Support your answer by providing the computation of Statutory Income.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

a Advise BMSB on the deductibility of RM40000 interest expense Support your answer with a computation of the restricted interest expense The deductibi... View full answer

Get step-by-step solutions from verified subject matter experts