Question: Bunkhouse Electronics is a recently incorporated firm that makes electronic entertainment systems. Its earnings and dividends have been growing at a rate of 35.0%,

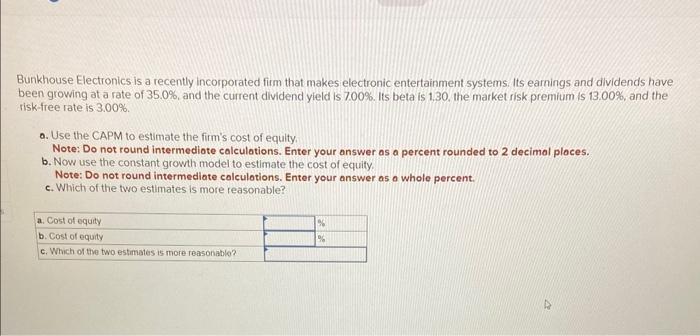

Bunkhouse Electronics is a recently incorporated firm that makes electronic entertainment systems. Its earnings and dividends have been growing at a rate of 35.0%, and the current dividend yield is 7.00%. Its beta is 1.30, the market risk premium is 13.00%, and the risk-free rate is 3.00%. a. Use the CAPM to estimate the firm's cost of equity. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. b. Now use the constant growth model to estimate the cost of equity. Note: Do not round intermediate calculations. Enter your answer as a whole percent. c. Which of the two estimates is more reasonable? a. Cost of equity b. Cost of equity c. Which of the two estimates is more reasonable? % %

Step by Step Solution

There are 3 Steps involved in it

Answer a CAPM Cost of Equity Risk free return Beta x Market ris... View full answer

Get step-by-step solutions from verified subject matter experts