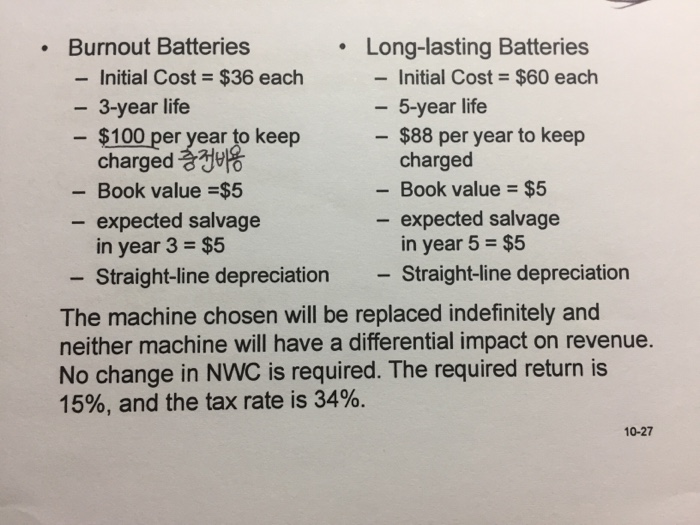

Question: .Burnout Batteries - Initial Cost-$36 each - 3-year life Long-lasting Batteries - Initial Cost- $60 each - 5-year life $88 per year to keep charged

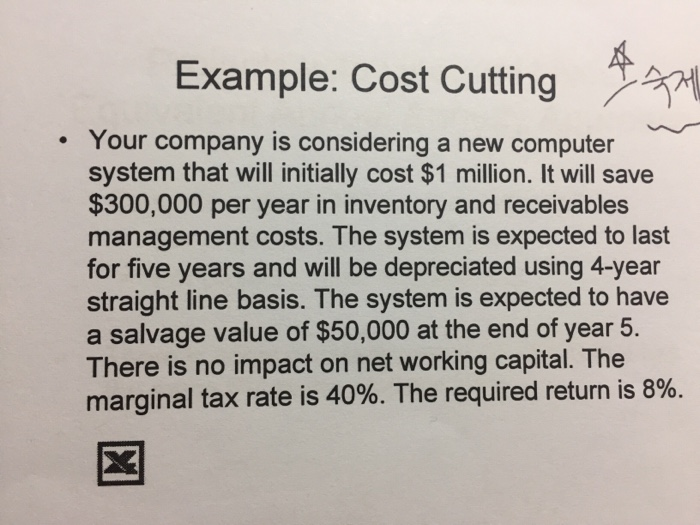

.Burnout Batteries - Initial Cost-$36 each - 3-year life Long-lasting Batteries - Initial Cost- $60 each - 5-year life $88 per year to keep charged $100 per year to keep charged 9 - Book value $5 - Book value- $5 - expected salvage expected salvage in year 5-$5 Straight-line depreciation in year 3- $5 - Straight-line depreciation The machine chosen will be replaced indefinitely and neither machine will have a differential impact on revenue. No change in NWC is required. The required return is 15%, and the tax rate is 34%. 10-27 Example: Cost Cutting Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 4-year straight line basis. The system is expected to have a salvage value of $50,000 at the end of year 5. There is no impact on net working capital. The marginal tax rate is 40%. The required return is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts