Question: Burt Batteries Pty Limited is evaluating a project that will last for 5 years and will produce earnings before interest and tax and Depreciation &

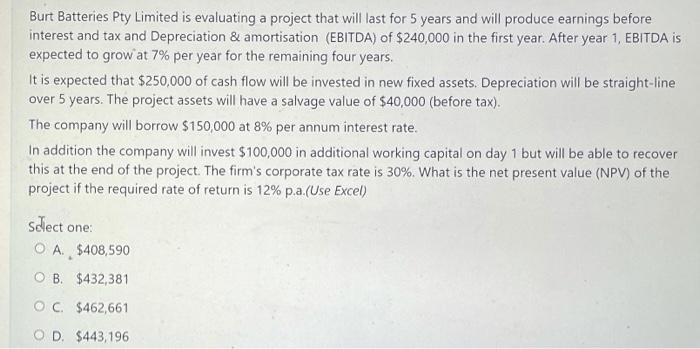

Burt Batteries Pty Limited is evaluating a project that will last for 5 years and will produce earnings before interest and tax and Depreciation & amortisation (EBITDA) of $240,000 in the first year. After year 1, EBITDA is expected to grow at 7% per year for the remaining four years. It is expected that $250,000 of cash flow will be invested in new fixed assets. Depreciation will be straight-line over 5 years. The project assets will have a salvage value of $40,000 (before tax). The company will borrow $150,000 at 8% per annum interest rate. In addition the company will invest $100,000 in additional working capital on day 1 but will be able to recover this at the end of the project. The firm's corporate tax rate is 30%. What is the net present value (NPV) of the project if the required rate of return is 12% p.a.(Use Excel) select one: O A $408,590 OB $432,381 OC. $462,661 O D. $443,196

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts