Question: BUS 2 0 3 - Test IV - 7 - SECTION III 4 0 Points On January 1 , 2 0 2 5 , Rider

BUS Test IV

SECTION III

Points

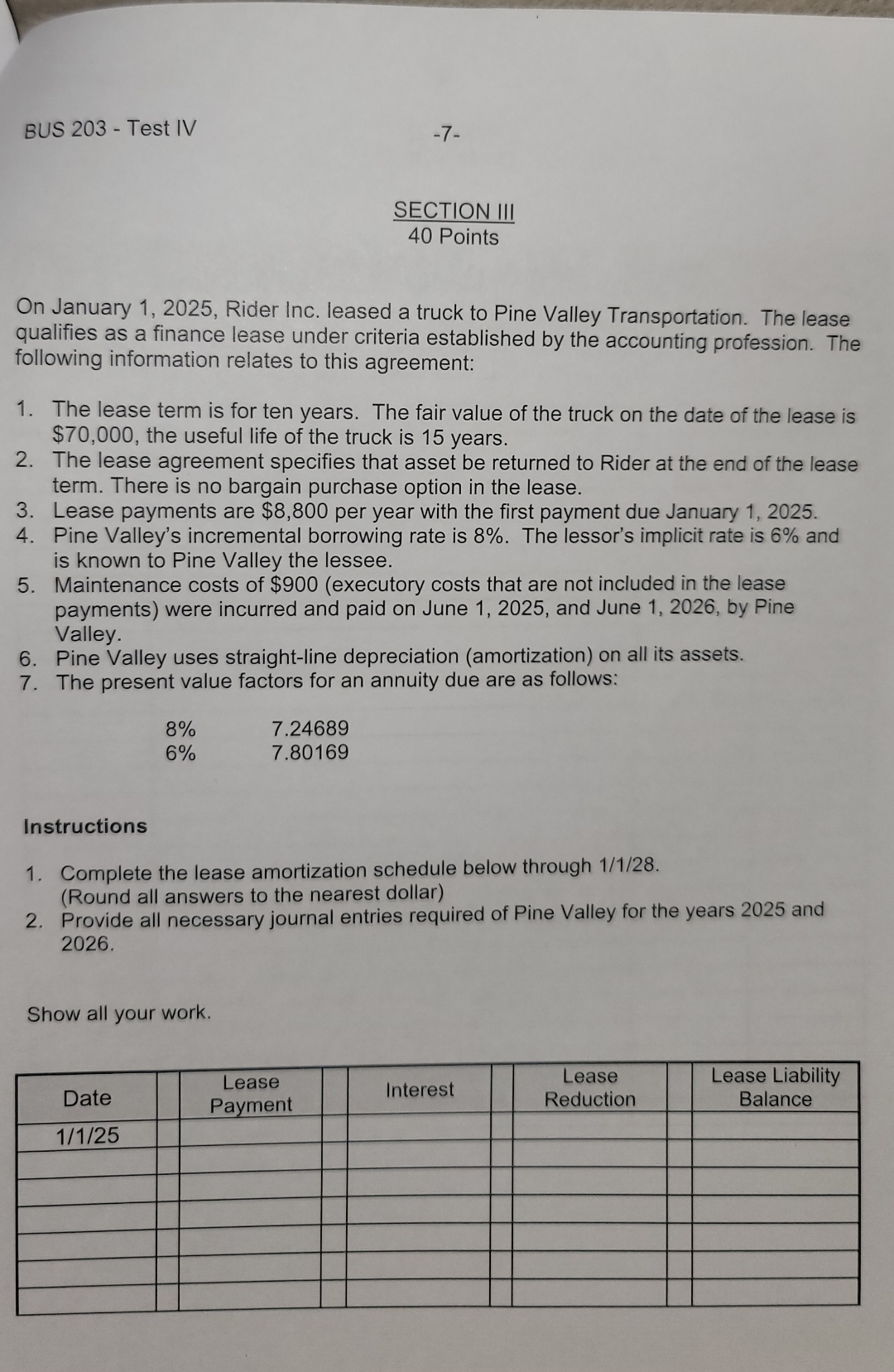

On January Rider Inc. leased a truck to Pine Valley Transportation. The lease qualifies as a finance lease under criteria established by the accounting profession. The following information relates to this agreement:

The lease term is for ten years. The fair value of the truck on the date of the lease is $ the useful life of the truck is years.

The lease agreement specifies that asset be returned to Rider at the end of the lease term. There is no bargain purchase option in the lease.

Lease payments are $ per year with the first payment due January

Pine Valley's incremental borrowing rate is The lessor's implicit rate is and is known to Pine Valley the lessee.

Maintenance costs of $executory costs that are not included in the lease payments were incurred and paid on June and June by Pine Valley.

Pine Valley uses straightline depreciation amortization on all its assets.

The present value factors for an annuity due are as follows:

table

Instructions

Complete the lease amortization schedule below through Round all answers to the nearest dollar

Provide all necessary journal entries required of Pine Valley for the years and

Show all your work.

tableDateLease Payment,Interest,Lease Reduction,Lease Liability Balance

SECTION II

Worksheet

tableDateAccount Titles and Explanation,DrCr

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock