Question: BUS2102-Spring 2019-Chapter 7 Fun& Exciting Exercises Always show your work when doing fun & exciting exercises! Box or circle final answers! Question 1) The Amazing

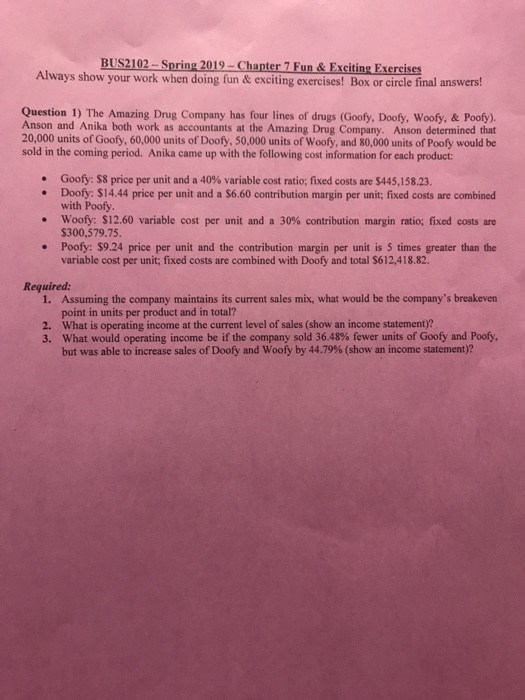

BUS2102-Spring 2019-Chapter 7 Fun& Exciting Exercises Always show your work when doing fun & exciting exercises! Box or circle final answers! Question 1) The Amazing Drug Company has four lines of drugs (Goofy, Doofy, Woofy, & Poofy). Anson and Anika both work as accountants at the Amazing Drug Company. Anson determined that 20,000 units of Goofy, 60,000 units of Doofy, 50,000 units of Woofy, and 80,000 units of Poofy would be sold in the coming period. Anika came up with the following cost information for each product Goofy: $8 price per unit and a 40% variable cost ratio; fixed costs are S445,1 5823. Doofy: S14.44 price per unit and a $6.60 contribution margin per unit, fixed costs are combined with Poofy. Woofy: S 12.60 variable cost per unit and a 30% contribution margin ratio; fixed costs are $300,579.75. . Poofy: $9.24 price per unit and the contribution margin per unit is 5 times greater than the variable cost per unit; fixed costs are combined with Doofy and total $612,418.82. Required Assuming the company maintains its current sales mix, what would be the company's breakeven point in units per product and in total? What is operating income at the current level of sales (show an income statement)? what would operating income be if the company sold 36.43% fewer units of Goofy and Poof but was able to increase sales of Doofy and woofy by 44.79% (show an income statement)? 1. 2. 3. BUS2102-Spring 2019-Chapter 7 Fun& Exciting Exercises Always show your work when doing fun & exciting exercises! Box or circle final answers! Question 1) The Amazing Drug Company has four lines of drugs (Goofy, Doofy, Woofy, & Poofy). Anson and Anika both work as accountants at the Amazing Drug Company. Anson determined that 20,000 units of Goofy, 60,000 units of Doofy, 50,000 units of Woofy, and 80,000 units of Poofy would be sold in the coming period. Anika came up with the following cost information for each product Goofy: $8 price per unit and a 40% variable cost ratio; fixed costs are S445,1 5823. Doofy: S14.44 price per unit and a $6.60 contribution margin per unit, fixed costs are combined with Poofy. Woofy: S 12.60 variable cost per unit and a 30% contribution margin ratio; fixed costs are $300,579.75. . Poofy: $9.24 price per unit and the contribution margin per unit is 5 times greater than the variable cost per unit; fixed costs are combined with Doofy and total $612,418.82. Required Assuming the company maintains its current sales mix, what would be the company's breakeven point in units per product and in total? What is operating income at the current level of sales (show an income statement)? what would operating income be if the company sold 36.43% fewer units of Goofy and Poof but was able to increase sales of Doofy and woofy by 44.79% (show an income statement)? 1. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts