Question: BUSA 4980 please show your work Exercise - M&A and Valuation Exercise: Facebook examines Chegg Ine for possible acquisition Description: In 2014, Facebook had been

BUSA 4980

please show your work

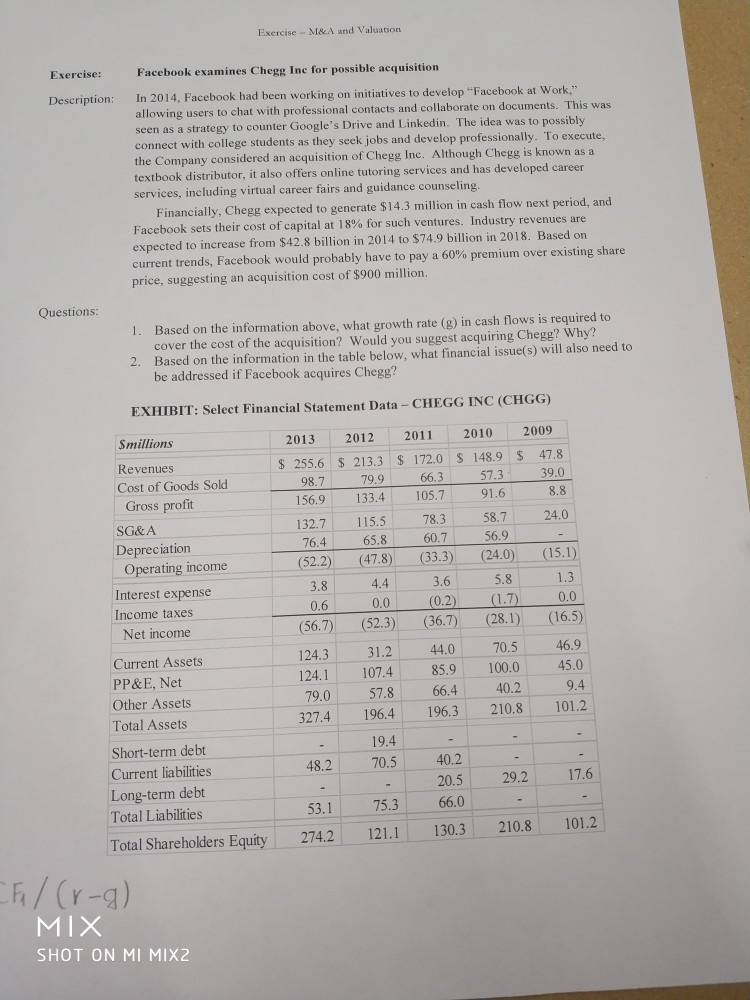

Exercise - M&A and Valuation Exercise: Facebook examines Chegg Ine for possible acquisition Description: In 2014, Facebook had been working on initiatives to develop "Facebook at Work." allowing users to chat with professional contacts and collaborate on documents. This was seen as a strategy to counter Google's Drive and Linkedin. The idea was to possibly connect with college students as they seek jobs and develop professionally. To execute, the Company considered an acquisition of Chegg Inc. Although Chegg is known as a textbook distributor, it also offers online tutoring services and has developed career services, including virtual career fairs and guidance counseling. Financially, Chegg expected to generate $14.3 million in cash flow next period, and Facebook sets their cost of capital at 18% for such ventures. Industry revenues are expected to increase from $42.8 billion in 2014 to $74.9 billion in 2018. Based on current trends, Facebook would probably have to pay a 60% premium over existing share price, suggesting an acquisition cost of $900 million. Questions: 1. Based on the information above, what growth rate (g) in cash flows is required to cover the cost of the acquisition? Would you suggest acquiring Chegg? Why? 2. Based on the information in the table below, what financial issue(s) will also need to be addressed if Facebook acquires Chegg? EXHIBIT: Select Financial Statement Data - CHEGG INC (CHGG) Smillions 66.3 Revenues Cost of Goods Sold Gross profit SG&A Depreciation Operating income Interest expense Income taxes Net income 2013 $ 255,6 98.7 156,9 132.7 76.4 (52.2) 3.8 0.6 (56.7) 124.3 124.1 79.0 327.4 - 48.2 2012 $ 213.3 79.9 133.4 115.5 65.8 (47.8) 4.4 0.0 (52.3) 31.2 107.4 57.8 196. 4 19.4 70.5 . 75.3 21.1 2011 2010 2009 $ 172.0 $ 148.9 $ 47.8 57.3 39.0 105.7 91.6 8.8 78.3 58.7 24.0 60.7 56.9 (33.3) (24.0) (15.1) 3.6 5.8 1.3 (0.2) (1.7) 0.0 (36.7) (28.1) (16.5) 44.0 70.5 46.9 85.9 100.0 45.0 66.4 40.2 9.4 1 96.3 210.8 101.2 - 40.2 20.5 29.2 17.6 66.0 130.3 210.8 101.2 Current Assets PP&E, Net Other Assets Total Assets Short-term debt Current liabilities Long-term debt Total Liabilities Total Shareholders Equity 53.1 274.2 Fu / (r-g) MIX SHOT ON MI MIX2 Exercise - M&A and Valuation Exercise: Facebook examines Chegg Ine for possible acquisition Description: In 2014, Facebook had been working on initiatives to develop "Facebook at Work." allowing users to chat with professional contacts and collaborate on documents. This was seen as a strategy to counter Google's Drive and Linkedin. The idea was to possibly connect with college students as they seek jobs and develop professionally. To execute, the Company considered an acquisition of Chegg Inc. Although Chegg is known as a textbook distributor, it also offers online tutoring services and has developed career services, including virtual career fairs and guidance counseling. Financially, Chegg expected to generate $14.3 million in cash flow next period, and Facebook sets their cost of capital at 18% for such ventures. Industry revenues are expected to increase from $42.8 billion in 2014 to $74.9 billion in 2018. Based on current trends, Facebook would probably have to pay a 60% premium over existing share price, suggesting an acquisition cost of $900 million. Questions: 1. Based on the information above, what growth rate (g) in cash flows is required to cover the cost of the acquisition? Would you suggest acquiring Chegg? Why? 2. Based on the information in the table below, what financial issue(s) will also need to be addressed if Facebook acquires Chegg? EXHIBIT: Select Financial Statement Data - CHEGG INC (CHGG) Smillions 66.3 Revenues Cost of Goods Sold Gross profit SG&A Depreciation Operating income Interest expense Income taxes Net income 2013 $ 255,6 98.7 156,9 132.7 76.4 (52.2) 3.8 0.6 (56.7) 124.3 124.1 79.0 327.4 - 48.2 2012 $ 213.3 79.9 133.4 115.5 65.8 (47.8) 4.4 0.0 (52.3) 31.2 107.4 57.8 196. 4 19.4 70.5 . 75.3 21.1 2011 2010 2009 $ 172.0 $ 148.9 $ 47.8 57.3 39.0 105.7 91.6 8.8 78.3 58.7 24.0 60.7 56.9 (33.3) (24.0) (15.1) 3.6 5.8 1.3 (0.2) (1.7) 0.0 (36.7) (28.1) (16.5) 44.0 70.5 46.9 85.9 100.0 45.0 66.4 40.2 9.4 1 96.3 210.8 101.2 - 40.2 20.5 29.2 17.6 66.0 130.3 210.8 101.2 Current Assets PP&E, Net Other Assets Total Assets Short-term debt Current liabilities Long-term debt Total Liabilities Total Shareholders Equity 53.1 274.2 Fu / (r-g) MIX SHOT ON MI MIX2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts