Question: BUSI 163 > Exchange Rate Determination Problem 18 * >> Intro The Brennon Group is a U.S. hedge fund that wants to benefit from the

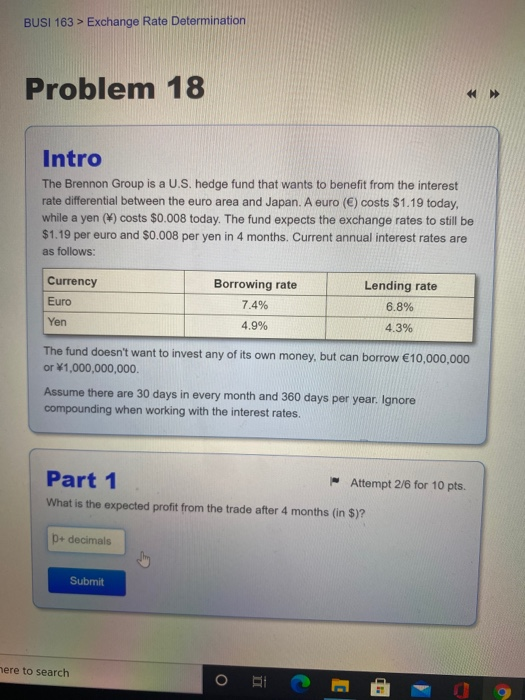

BUSI 163 > Exchange Rate Determination Problem 18 * >> Intro The Brennon Group is a U.S. hedge fund that wants to benefit from the interest rate differential between the euro area and Japan. A euro () costs $1.19 today, while a yen (*) costs $0.008 today. The fund expects the exchange rates to still be $1.19 per euro and $0.008 per yen in 4 months. Current annual interest rates are as follows: Currency Euro Borrowing rate 7.4% Lending rate 6.8% Yen 4.9% 4.3% The fund doesn't want to invest any of its own money, but can borrow 10,000,000 or $1,000,000,000 Assume there are 30 days in every month and 360 days per year. Ignore compounding when working with the interest rates. Part 1 Attempt 2/6 for 10 pts. What is the expected profit from the trade after 4 months (in $)? D+ decimals Submit here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts