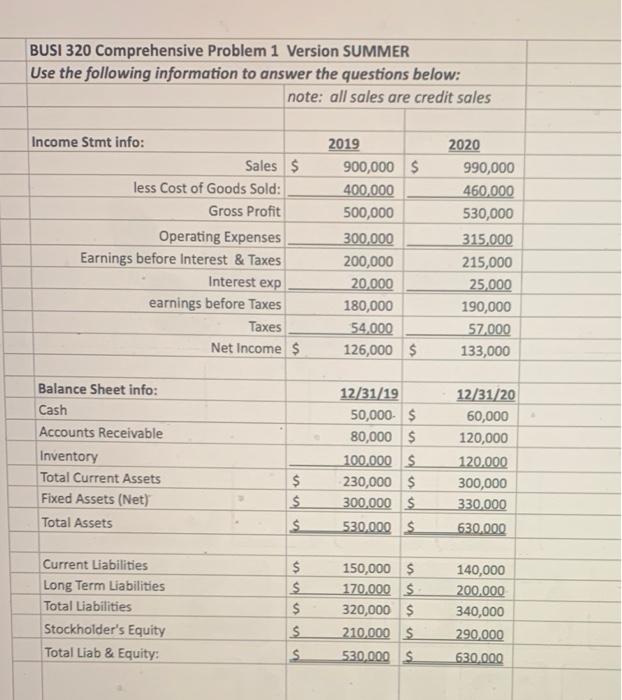

Question: BUSI 320 Comprehensive Problem 1 Version SUMMER Use the following information to answer the questions below: note: all sales are credit sales Income Stmt info:

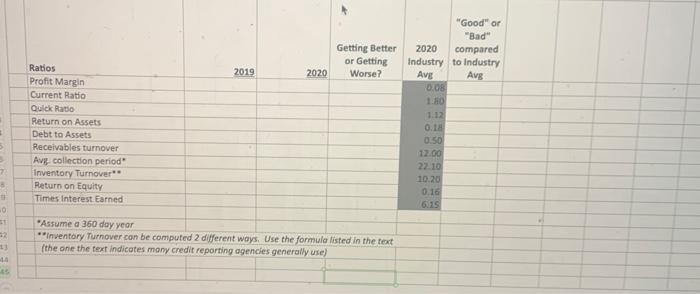

BUSI 320 Comprehensive Problem 1 Version SUMMER Use the following information to answer the questions below: note: all sales are credit sales Income Stmt info: Sales $ less Cost of Goods Sold: Gross Profit Operating Expenses Earnings before Interest & Taxes Interest exp earnings before Taxes Taxes Net Income $ 2019 900,000 $ 400,000 500,000 300.000 200,000 20.000 180,000 54.000 126,000 $ 2020 990,000 460,000 530,000 315,000 215,000 25,000 190,000 57.000 133,000 Balance Sheet info: Cash Accounts Receivable Inventory Total Current Assets Fixed Assets (Net) Total Assets 12/31/19 50,000 $ 80,000 $ 100.000 S 230,000 $ 300,000 $ 530.000 12/31/20 60,000 120,000 120.000 300,000 330.000 630.000 $ $ $ Current Liabilities Long Term Liabilities Total Liabilities Stockholder's Equity Total Liab & Equity: $ $ $ S 150,000 $ 170,000 $ 320,000 $ 210,000 $ 530,000 $ 140,000 200.000 340,000 290,000 630.000 Getting Better or Getting Worse? 2019 2020 Ratios Profit Margin Current Ratio Quick Ratio Return on Assets Debt to Assets Receivables turnover Avg. collection period Inventory Turnover Return on Equity Times Interest, Earned "Good" or "Bad" 2020 compared Industry to Industry AVE Avg 0.08 1.80 1.12 0.18 0:50 12.00 22.10 10.20 0.16 625 7 .0 51 2 "Assume a 360 day year **Inventory Turnover con be computed 2 different ways. Use the formule listed in the text (the one the text indicates many credit reporting agencies generally use)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts