Question: BUSI 320 Comprehensive Problem 3 FALL 2017 Use what you have learned about the time value of money to analyze each of the following decisions:

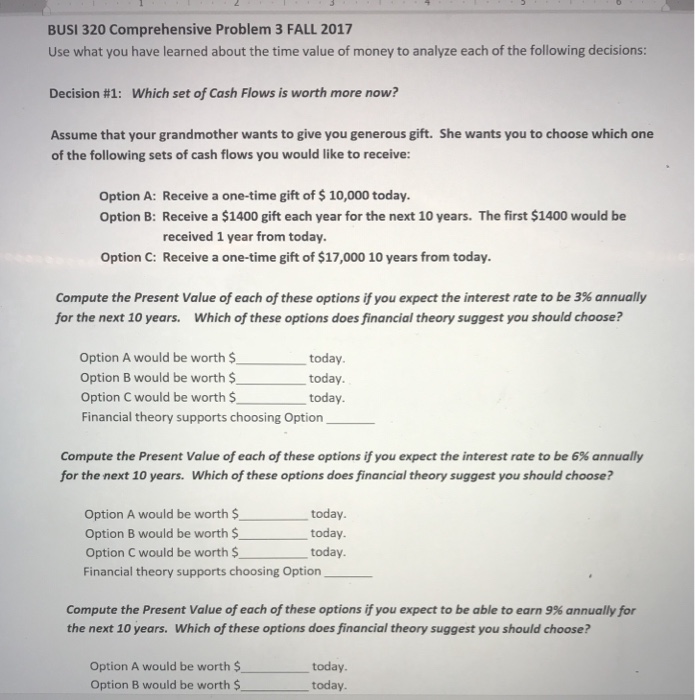

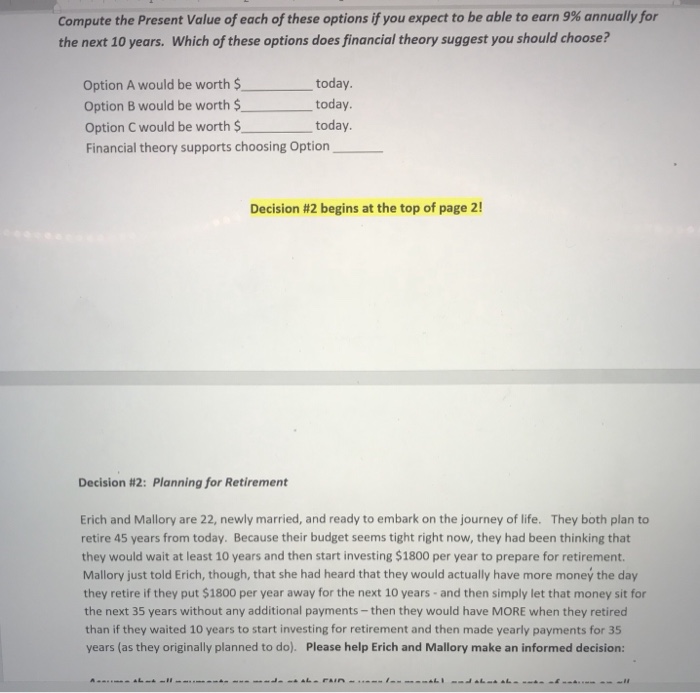

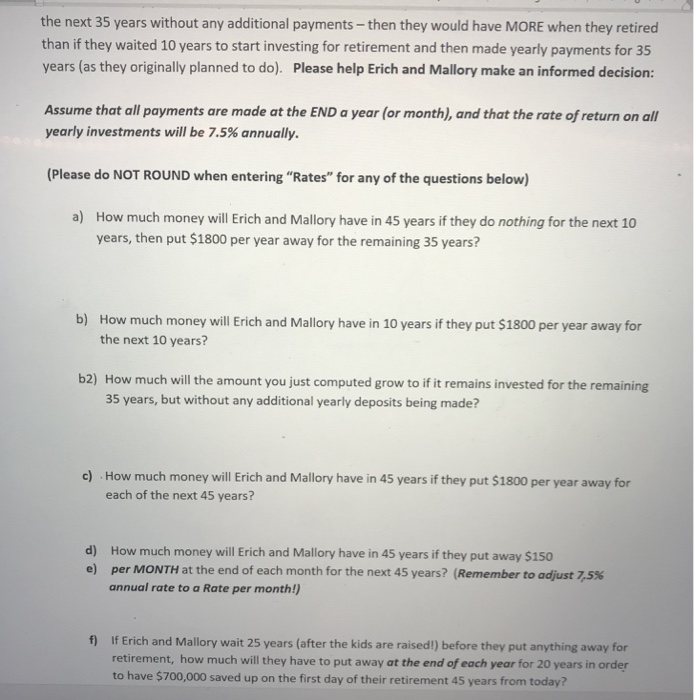

BUSI 320 Comprehensive Problem 3 FALL 2017 Use what you have learned about the time value of money to analyze each of the following decisions: Decision #1: Which set of Cash Flows is worth more now? Assume that your grandmother wants to give you generous gift. She wants you to choose which one of the following sets of cash flows you would like to receive Option A: Receive a one-time gift of $ 10,000 today Option B: Receive a $1400 gift each year for the next 10 years. The first $1400 would be received 1 year from today. Option C: Receive a one-time gift of $17,000 10 years from today. Compute the Present Value of each of these options if you expect the interest rate to be 3% annually for the next 10 years. Which of these options does financial theory suggest you should choose? Option A would be worth $ Option B would be worth$ today Option C would be worth S Financial theory supports choosing Option today today. Compute the Present Value of each of these options if you expect the interest rate to be 6% annually for the next 10 years. Which of these options does financial theory suggest you should choose? Option A would be worth$ Option B would be worth$ Option C would be worth $ Financial theory supports choosing Option today. today. today. Compute the Present Value of each of these options if you expect to be able to earn 9% annually for the next 10 years. Which of these options does financial theory suggest you should choose? Option A would be worth$ Option B would be worth $ today. today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts