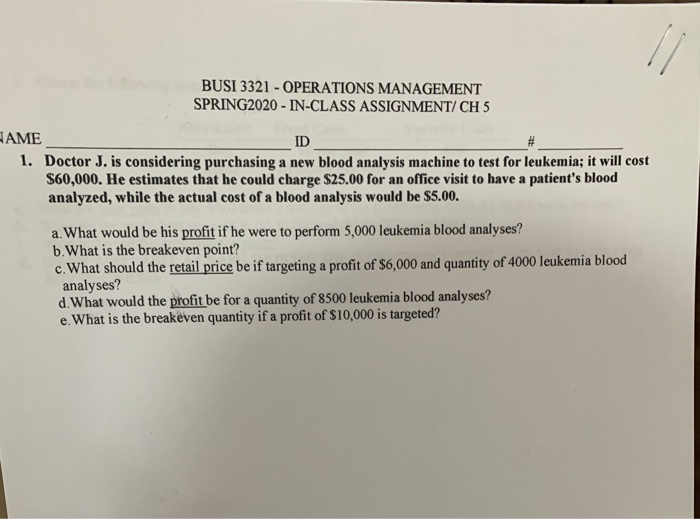

Question: BUSI 3321 - OPERATIONS MANAGEMENT SPRING2020 - IN-CLASS ASSIGNMENT/CH 5 AME 1. Doctor J. is considering purchasing a new blood analysis machine to test for

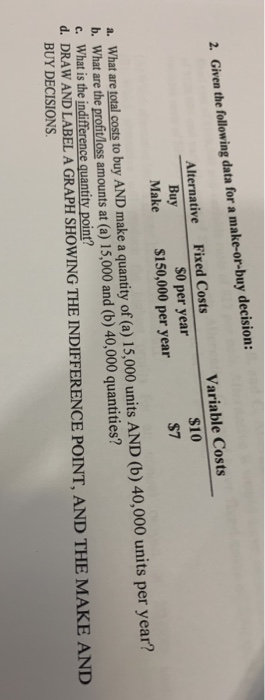

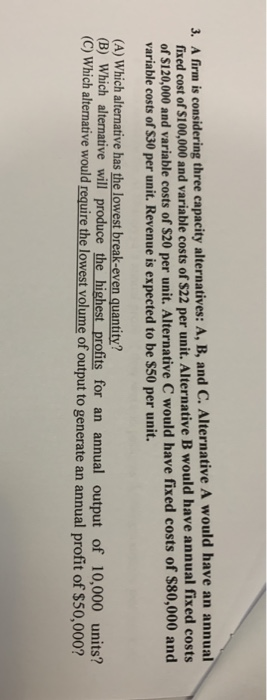

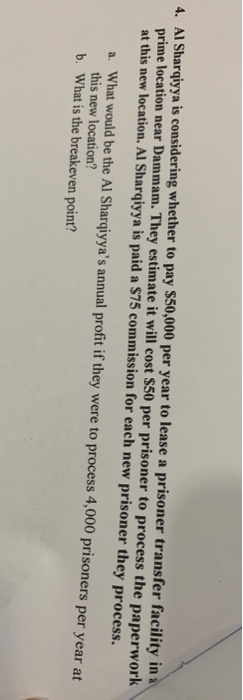

BUSI 3321 - OPERATIONS MANAGEMENT SPRING2020 - IN-CLASS ASSIGNMENT/CH 5 AME 1. Doctor J. is considering purchasing a new blood analysis machine to test for leukemia; it will cost $60,000. He estimates that he could charge $25.00 for an office visit to have a patient's blood analyzed, while the actual cost of a blood analysis would be $5.00. a. What would be his profit if he were to perform 5,000 leukemia blood analyses? b. What is the breakeven point? c. What should the retail price be if targeting a profit of $6,000 and quantity of 4000 leukemia blood analyses? d. What would the profit be for a quantity of 8500 leukemia blood analyses? e. What is the breakeven quantity if a profit of $10,000 is targeted? 2. Given the following data for a make-or-buy decision: Variable Costs Alternative Fixed Costs $10 Buy SO per year Make $150,000 per year $7 a. What are total costs to buy AND make a quantity of (a) 15,000 units AND (b) 40,000 units per year? b. What are the profit/loss amounts at (a) 15,000 and (b) 40,000 quantities? c. What is the indifference quantity point? d. DRAW AND LABEL A GRAPH SHOWING THE INDIFFERENCE POINT, AND THE MAKE AND BUY DECISIONS 3. A firm is considering three capacity alternatives: A, B, and C. Alternative A would have an annual fixed cost of $100,000 and variable costs of S22 per unit. Alternative B would have annual fixed costs of S120,000 and variable costs of $20 per unit. Alternative C would have fixed costs of $80,000 and variable costs of $30 per unit. Revenue is expected to be $50 per unit. (A) Which alternative has the lowest break-even quantity? (B) Which alternative will produce the highest profits for an annual output of 10,000 units? (C) Which alternative would require the lowest volume of output to generate an annual profit of $50,000? 4. Al Sharqiyya is considering whether to pay $50,000 per year to lease a prisoner transfer facility in a prime location near Dammam. They estimate it will cost $50 per prisoner to process the paperwork at this new location. Al Sharqiyya is paid a $75 commission for each new prisoner they process. a. What would be the Al Sharqiyya's annual profit if they were to process 4,000 prisoners per year at this new location? b. What is the breakeven point