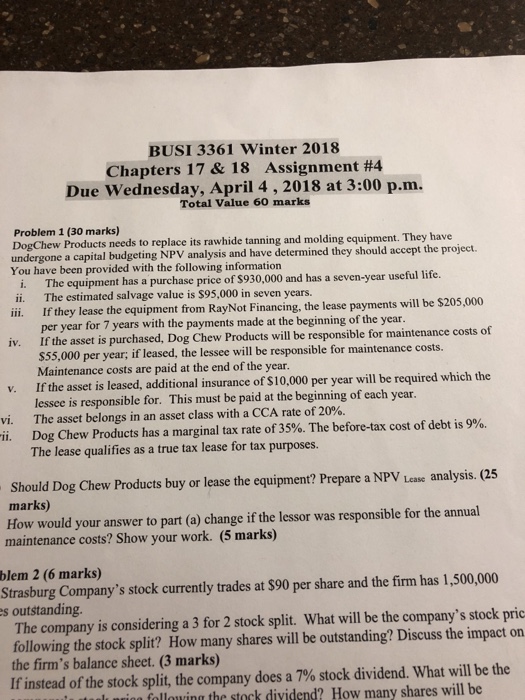

Question: BUSI 3361 Winter 2018 Chapters 17 & 18 Assignment #4 Due Wednesday, April 4, 2018 at 3:00 p.m. Total Value 60 marks Problem 1 (30

BUSI 3361 Winter 2018 Chapters 17 & 18 Assignment #4 Due Wednesday, April 4, 2018 at 3:00 p.m. Total Value 60 marks Problem 1 (30 marks) DogChew Products needs to replace its rawhide tanning and molding equipment. They have undergone a capital budgeting NPV analysis and have determined they should accept the project. You have been provided with the following information i. ii. The estimated salvage value is $95,000 in seven years. ii. If they lease the equipment from RayNot Financing, the lease payments will be $205,000 The equipment has a purchase price of $930,000 and has a seven-year useful life. per year for 7 years with the payments made at the beginning of the year If the asset is purchased, Dog Chew Products will be responsible for maintenance costs of iv. per year; if leased, the lessee will be responsible for maintenance costs. Maintenance costs are paid at the end of the year. v. If the asset is leased, additional insurance of S10,000 per year will be required which the lessee is responsible for. This must be paid at the beginning of each year. The asset belongs in an asset class with a CCA rate of 20%. vi. ii. Dog Chew Products has a marginal tax rate of 35%. The before-tax cost of debt is 9%. The lease qualifies as a true tax lease for tax purposes. Should Dog Chew Products buy or lease the equipment? Prepare a NPV Leae analysis. (25 marks) How would your answer to part (a) change if the lessor was responsible for the annual maintenance costs? Show your work. (5 marks) blem 2 (6 marks) Strasburg Company's stock currently trades at $90 per share and the firm has 1,500,000 s outstanding. The company is considering a 3 for 2 stock split. What will be the company's stock pric following the stock split? How many shares will be outstanding? Discuss the impact on the firm's balance sheet. (3 marks) If instead of the stock split, the company does a 7% stock dividend. What will be the follouing the stock dividend? How many shares will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts