Question: busi 640 question3 3. You have two mutually exclusive projects that you have been asked to evaluate and make a recommendation. Assume that investors opportunity

busi 640 question3

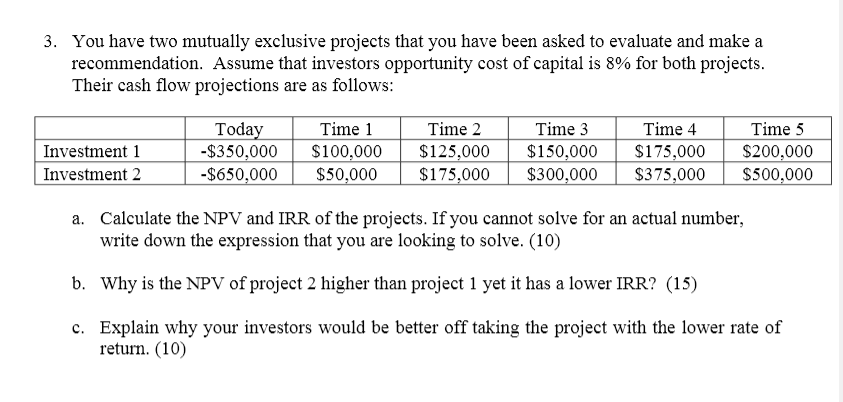

3. You have two mutually exclusive projects that you have been asked to evaluate and make a recommendation. Assume that investors opportunity cost of capital is 8% for both projects. Their cash ow projections are as follows: Today Time 1 Time 2 Time 3 Time 4 Time 5 Investment 1 -$350,000 $100,000 $ 125,000 $150, 000 $175, 000 $200,000 Investment 2 -$650,000 $50,000 $175,000 $3 00,000 $375,000 $500,000 a. Calculate the NPV and IR of the projects. If you cannot solve for an actual number, write down the expression that you are looking to solve. (10) b. Why is the NPV ofproject 2 higher than project 1 yet it has a lower IR? (15) c. Explain why your investors would be better off taking the project with the lower rate of retum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts